Original Link | DailyReckoning by ZACH SCHEIDT

Table of Contents

There’re Two Very Different Types of Life Insurance

The concept behind life insurance is pretty simple: You pay an insurance company a monthly premium for a specified number of years. And if you pass away during this time, the insurance company pays a lump sum to your loved ones.

— Sponsored Link —

Learn The Strategy That Could Pay You Up To $2,000 or More Every Week

This type of “term” policy is extremely valuable for people like me — with a young family that counts on me to earn the money to cover day-to-day expenses. And for most individuals, this type of policy is fairly inexpensive. For about the same cost as my monthly water bill, my family can receive a couple million dollars to help with if expenses if I’m not around to take care of them.

Perhaps you are in a similar situation with loved ones that count on you for income or to provide care for kids or other family members.

Unfortunately, while the basic concept behind life insurance is easy to understand, the life insurance industry has added nuances to these products that can make buying life insurance much more complicated.

A different type of life insurance that agents are aggressively selling is often referred to as “whole” life insurance. Incidentally, this is the type of insurance that my friend Jon was trying to sell me.

At its core, “whole” life insurance is similar to the “term” policy that I just showed you.

Except whole life insurance has a couple of added features. Features that you certainly pay for…

For one thing, whole life insurance policies typically have no expiration date. So if you buy a whole life insurance policy, it doesn’t matter if you die early, or if you die at a ripe old age. Either way, the policy will pay a sum of money to your beneficiaries.

Second, most whole life insurance plans have a “cash value” component.

The way this works, is that you pay extra to the insurance company and they accumulate that extra cash as part of your ultimate payout. Over time, that cash value is guaranteed to grow at a specific rate. And for some policies, the cash value can be used to pay for future monthly premiums.

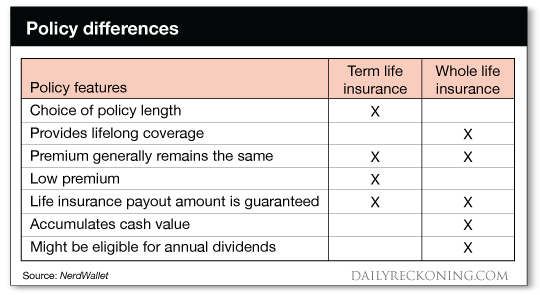

Here’s a quick table I came across recently that explains the differences between term and whole life insurance.

No Such Thing as a Free Lunch

I grew up in a big family, and my mom always told us kids “there’s no such thing as a free lunch.”

Usually, that meant it was time to do the dishes or some other chore. But what my mom was really trying to teach us is that there is always a catch when it appears you’re getting an extra benefit.

“So I bought one of those stocks,” he told me, laughing slightly. “And it hasn’t done so well.”

My first question – as it always is in these situations – was “Did you use a trailing stop?”

He shook his head. “I was supposed to hold the company for the next five years, so I didn’t think it was necessary.”

Now, I’ll pause here to say this: I am a product of the new millennium.

My investing life began during the dot-com crash, only to be followed a few years later by the financial crisis.

I know nothing but boom-and-bust cycles. And, as a result, I don’t fear volatility. Nor do I fear collapses or sell-offs.

A rally can’t exist without a sell-off or correction, and vice versa.

Sell-offs are my friends. They allow me to scoop up companies I’ve been eyeing at discount prices.

And rallies, when they come, are always welcome. But I always view them with suspicion – because I never know how long our relationship will last.

The goal is to get in, protect your profits, get out and move on.

Now back to my conversation…

The man told me the name of the stock he purchased: Enerplus Corporation (NYSE: ERF).

He asked, “What should I do now?”

I pulled out my phone and pulled up charts for the company. Here’s what I saw…

Not a pretty picture, is it? The only answer I could give was “I can’t tell you what you should do. BUT, in the future, you should absolutely use a trailing stop.”

I don’t know how much this gentleman invested in this company. But let’s say $10,000 to demonstrate my point. Let’s also assume he bought the stock at open on April 15, 2014.

The company pays dividends, but I’m not going to include them because of their small sizes.

So $10,000 in Enerplus would have given him 475.74 shares at $21.02.

Today, Enerplus is trading at $8.99. So his original $10,000 investment is worth $4,276.90. (That’s actually good news as shares are up from the sub-$2 range they were trading for earlier this year… Hooray!)

That’s a loss of 57.23%. Ouch.

Now let’s say instead of holding this position, he implemented a 25% end-of-day trailing stop (what we use at The Oxford Club). At the original purchase price of $21.02, his initial trailing stop would’ve been $15.77.

But as shares move higher, so does the stop. Enerplus did have a solid run, hitting a closing high of $25.23 on July 2, 2014. So his 25% trailing stop would have moved higher to $18.92.

The stop would have been triggered on September 19, 2014. Selling at the next open for $19.08, he would have had a loss of just 9.23%.

Altogether, his original $10,000 investment would have been worth $9,077. A loss, but only a single-digit loss.

I’m sure you’d agree it’s far better than the -57.23% return he’s currently sitting on.

Using a stop loss would have also kept him from worrying for two years straight, the pressure steadily mounting.

I don’t want you to think I’m picking on this gentleman. In all honesty, I completely understand why he didn’t sell. Fact is, we are all less likely to hit the sell button on a loss than a gain.

That’s precisely why it’s so important to use stops. They completely remove emotion from the equation.

And who knows? Maybe over the next two years, Enerplus will gain 134%. (That’s what he’ll need to get back to his original buy price.)

It always amazes me that trailing stops are seen as a controversial strategy. At conferences, I always hear, “But what if it bounces higher after I’m bucked out of the stock? I’ll have missed out on that!”

That’s true. But it’s not the point.

The point is… What if your shares go even lower?

Trailing stops make sure you never find yourself in that position. That you never have to ask, “What should I do now?”

Whole life insurance policies are sold by insurance companies, because they make so much sense… for the insurance companies!

You see, when you pay extra for a whole life insurance policy, the insurance company takes the extra money and it invests that cash. Over time, the value of this extra cash grows and grows. And some of that cash goes to you as the policyholder.

But the reason whole life insurance companies push these whole life insurance policies so aggressively is because they are so profitable.

These insurance companies employ armies of statisticians who crunch the numbers on everything from how long you’re likely to live, to how much money they can make on your money before they have to pay you.

And the end result is that insurance companies make much more by charging you extra for whole life insurance, than they will ultimately pay your heirs when you pass away.

So instead of being a great investment that helps you pass wealth on to your loved ones, whole life insurance policies are usually just high-cost product that slowly erodes the wealth you could have been growing…

A Better Way to Prepare for the Future

Now I don’t want to discourage you from buying life insurance for your loved ones. Especially if you’re still in a life period where people are counting on you to provide for them.

But I’d rather see you protect your family AND build your wealth at the same time.

That’s why I strongly encourage you to politely say “no thanks” when your insurance agent or financial planner tries to sell you whole life insurance, and take a more effective strategy.

Instead of paying extra for a whole life insurance policy, buy a term policy that covers the amount of time that people will be relying on you for needed income. In my case, that’s about another 15 years until my youngest moves out of the house.

Once you’ve purchased your cheaper term life insurance policy, take the extra money that you would have spent on a whole life policy, and start investing in solid dividend-paying stocks. The kind of stocks that I feature regularly in my Lifetime Income Report service.

You’ll find that over time, the wealth you accumulate from saving money on your life insurance premiums — and investing those savings for yourself instead of letting the insurance company invest for its own gain — will go much farther in growing your wealth.

And best of all, you can decide exactly when and how to pass that wealth on to your loved ones. Instead of waiting for a life insurance policy to pay out when you’re no longer around.

So please do yourself and your heirs a favor. Avoid the whole life insurance scam and take charge of your own investments. You’ll be much better off and grow your wealth much more quickly that way.

Overwhelmed by cryptocurrencies? Don’t be. Go here and claim your seat to a cryptocurrency masterclass.

Inside, you’ll learn all the secrets to making a fortune from this red hot market.