Last week I went back to The Basics of Swing Trading, a course I recorded 7 years ago, made 3 swing trades and won on all 3, taking home +$6,200.

This week I used the same strategy and have made 4 swing trades and already closed 2 of them for wins +$5,800 for a 2-week total of 5 for 5 and $12,000 realized gain.

Point is, sometimes we overthink it, we overtrade and sometimes, usually most of the time, less is more. It’s good to be back my friends.

—– Related —–

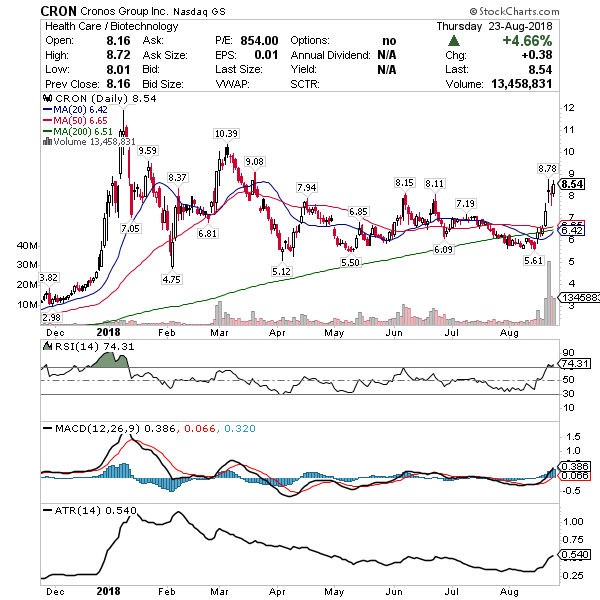

U.S. stock futures are advancing strongly this morning and sector leading pot stocks are advancing nicely, with small cap leader CRON in the top 5 movers gapping up +7% already.

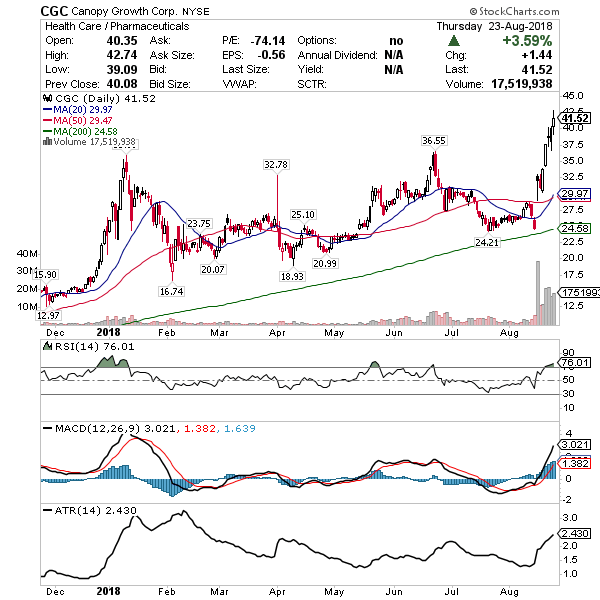

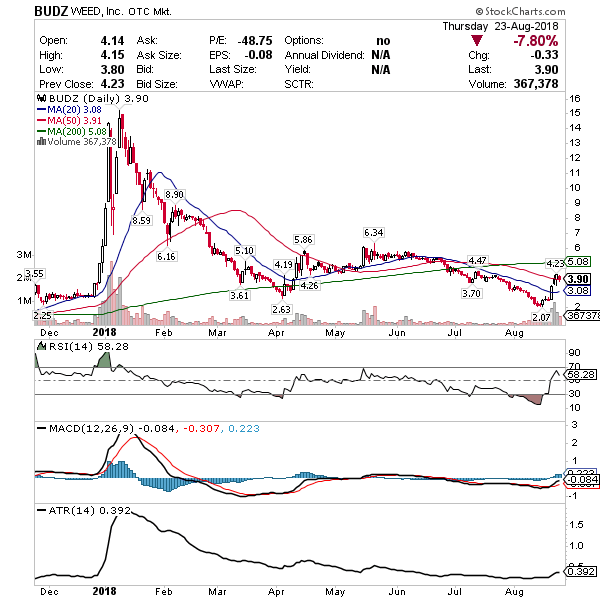

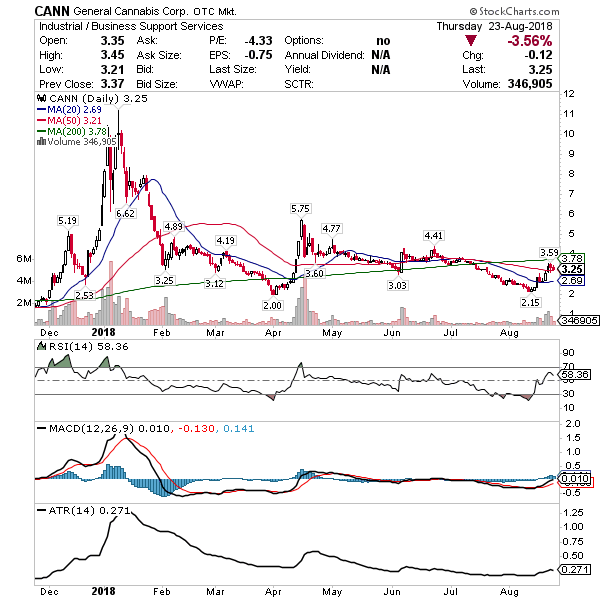

Large cap CGC is climbing premarket as well. This will no doubt pull CANN and BUDZ higher.

I sold BUDZ yesterday +$1,800 to pay myself since it slowed down at the MA(50) but may buy back near the open if possible looking for middle to upper $4’s. Probably 5,000 shares again for $.50 / share or $2,500 profit.

Additionally, I’m considering adding 2,000 CANN today as I expect that to move up about 10%+ too. Both BUDZ and CANN I’d be looking to take profit on today. If these pot stocks are going to put in a big stick, Friday would be the ideal day for it to happen due to market being up, pot stocks in general gapping higher and typical Friday short squeeze pressure.

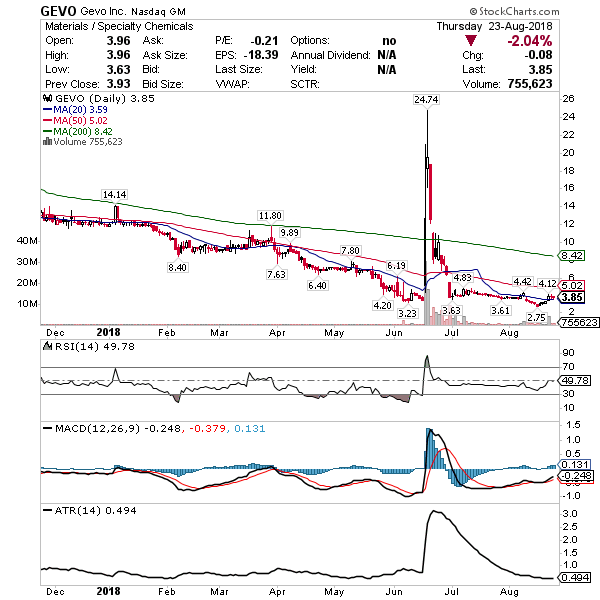

GEVO hasn’t made its move yet off that form 4 filing but it was a big enough filing for me to keep swinging the position. I doubt I’ll add size here unless it’s popping but instead be patient for the likely news to hit. Again, insiders sell for a number of reason, they only buy before the stock is about to go up.

No updates on long-term LQMT or ROX, my thesis on both is unchanged and when there’s something to write about, I’ll provide a detailed report on each.

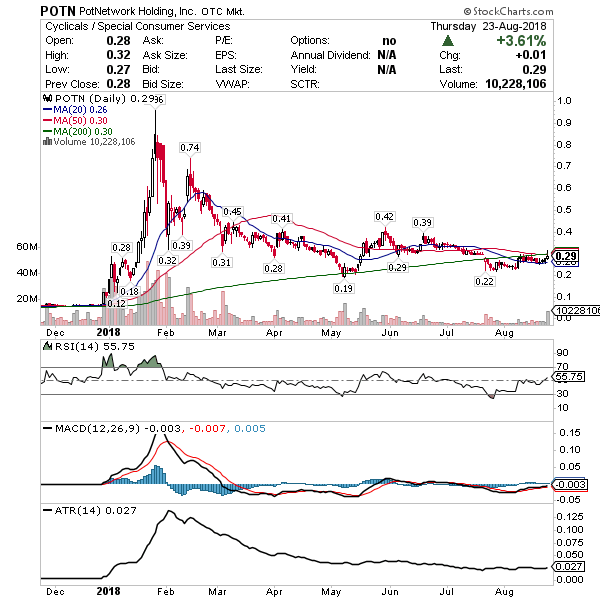

POTN is another pot stock I’m looking at today. Shares are lifting a bit off the MA(20) with a lot of upside. Goal would be 50,000 shares looking for $.10 / share or $5,000 in profit.

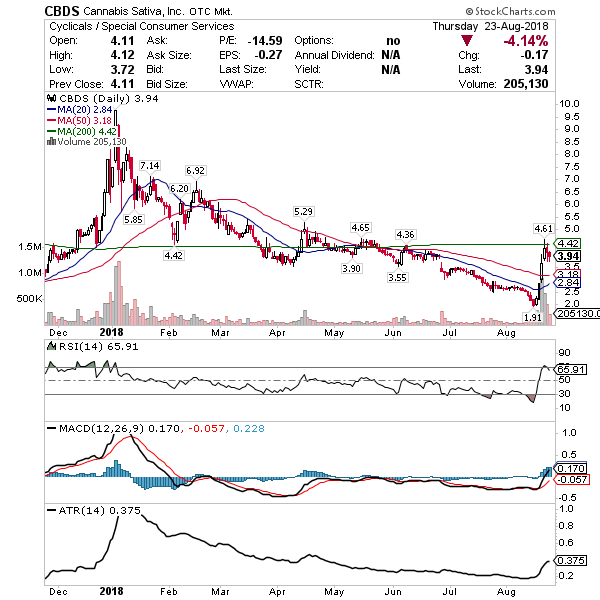

CBDS is a another pot stock similar pattern to BUDZ and CANN that I’m interested in as well. This trade is in play Friday above $3.72, looking for a break of the low $4’s to trigger a middle $4’s move. I’m thinking 5,000 shares for $.50 a share or $2,500 profit here.

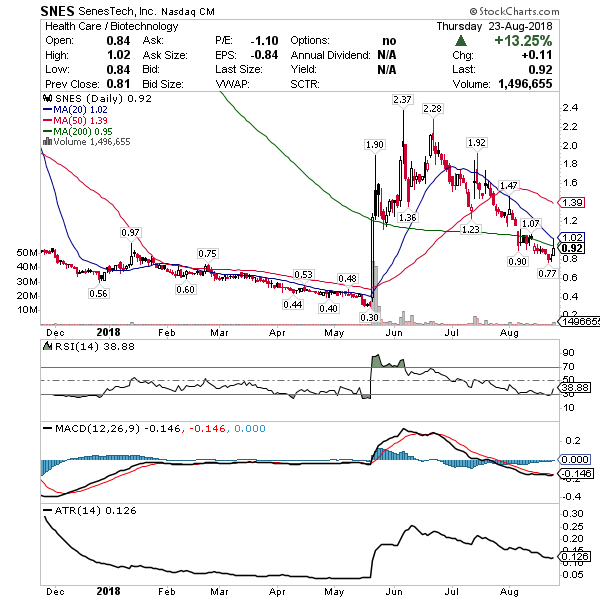

Finally SNES from yesterday’s watch list is starting to move on a rise in volume. I like this above $.90 for a swing to the $1.20’s and $.20 / share on 10,000 shares or $2,000 profit.

[Ed. Note: Jason Bond runs JasonBondPicks.com and is a swing trader of small-cap stocks. In 2015 he earned a 180% return on his money. Then in 2016 he turned a $100,000 account into $430,000! Discover How He Did It]