After a strong fourth quarter and Santa Claus rally, stocks kicked off 2020 with a bit of whiplash.

Bulls were shaken up a bit to start the year, after President Donald Trump ordered the assassination of a top Iranian general.

Iran then threatened “harsh revenge.”

The news fueled concerns about oil supplies from the Middle East, sending crude prices skyrocketing.

In addition, gold prices got a boost—hitting seven year highs… as geopolitical fears had traders seeking safety in tangible assets.

However, as I told my paid Weekly Windfalls subscribers earlier this week — one thing I’ve learned in 10 years of trading is it can get very, very costly trying to predict the top of a market.

So, while I’m mindful of these overbought conditions — and I still think we’ll see the end of this 11-year bull run sooner rather than later — I’d like to go over three things I’ve learned about positioning during unpredictable markets.

Table of Contents

1) How to Balance Your Portfolio

As I’ve said before, once overall market sentiment is decided — to the bullish or bearish side — weight your trades accordingly.

That is, I prefer to weight 70% of the positions to go along with market sentiment, and the other 30% as contrarian trades, to reduce exposure to unexpected volatility.

So right now, I’m aiming to have 70% of my Weekly Windfalls trades on the bullish side — selling bull put spreads on strong stocks or stocks with firm support in place.

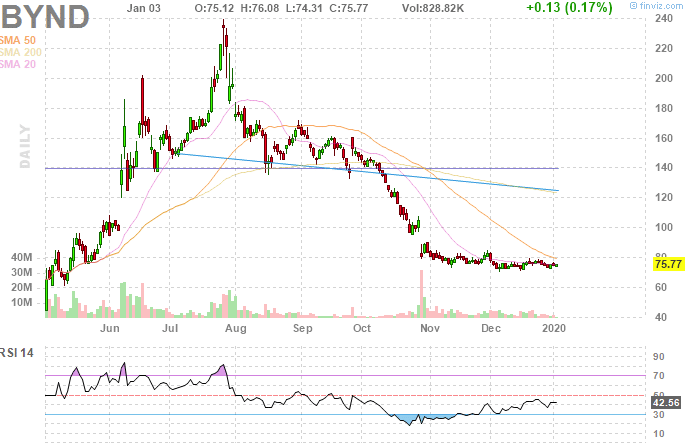

For instance, on Friday, Jan. 3, I let my premium subscribers know that Beyond Meat (BYND) looked ripe for a bullish trade.

The stock was diverging from the market, which indicated BYND was poised to squeeze.

With the shares trading around $75.89, I initiated a bull put spread.

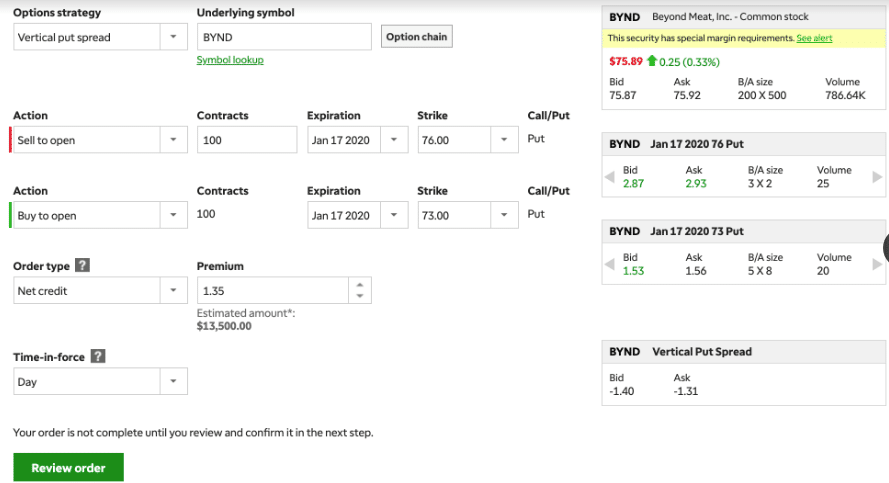

That means I:

- Sold the weekly 1/17 76-strike put, as I expected BYND to move and stay above $76 in the short term

- Bought “options insurance” by purchasing the weekly 1/17 73-strike put, which would limit losses in the event BYND turned lower and breached $73

Subtracting the premium I paid for the lower-strike, out-of-the-money (OTM) put from the premium I received from selling the 76-strike put, my spread was established for a net credit of $1.35, or $13,500 total (since I trade 100 contracts and each contract controls 100 shares of BYND).

Then, on Tuesday, Jan. 7, BYND had jumped above $77.25, thanks to a nice 4% bounce!

As such, I booked a cool $2,800 windfall — in less than three sessions!

And I wasn’t the only one, as you can see from this nice subscriber message… (Thanks, Craig!)

The other 30% of my Weekly Windfalls trades are on the bearish side — selling bear call spreads on weaker stocks or securities facing off against stern resistance.

I’ve found that when there’s an unexpected crash, as long as 30% of my portfolio is bearish, I can hang in there, because the strong stocks usually rebound.

To put on a bear call spread, you would:

- Sell a call option that aligns with resistance for the stock

- Buy a higher-strike call option to protect against losses, should the shares rally

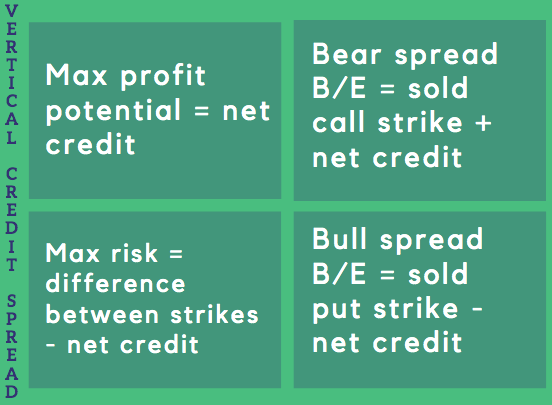

The premium you receive for the vertical call spread represents the most you can possibly make on the trade, and requires the underlying stock to move and/or stay below the sold call strike through expiration.

Of course, you don’t have to wait until expiration to close out your spreads — you can take profits or cut losses anytime.

Speaking of losses, the maximum risk on a bear call spread — and a bull put spread, for that matter — is calculated by subtracting the net credit from the difference between your sold and bought strikes.

So, if you implemented a spread at the 100 and 103 strikes for a net credit of $1.25, your risk would be $1.75 ([103 – 100] – $1.25).

2) Make the Next Best Decision When Caught Off-Guard

We all have losing trades, guys and gals. It’s part of the game.

But as I’ve said several times, whenever you’re pushed down in life, you have to dust yourself off and learn from your mistakes.

One thing I’ve learned from dealing with unexpected volatility over the past decade: Shake off your losses and go at it again.

That means when I have a losing trade during a roller-coaster market, I’ll often PUT ON THE SAME TRADE FURTHER OUT IN TIME, which usually offsets the losing trade — especially when it comes to selling puts on typically strong stocks.

For instance, a few months back, I was taken by surprise when two of my positions were assigned and I suffered the maximum loss.

However, I still liked those trade setups.

So, after an easy, breezy 10-mile jog to clear my head, I made the next best decision for me: I sold more puts on those same two stocks, using options 1-2 weeks out, because probability was still in my favor to win big.

By shaking off my losses and extending my trades, I was able to bank NEARLY $70,000 in TWO SESSIONS — more than enough to offset my initial losses.

3) Sink Your Teeth Into Juicy Premiums

When the stock market is volatile, or when traders are expecting volatility, implied volatility (IV) tends to run hotter.

The Cboe Volatility Index (VIX) reflects Wall Street’s short-term volatility expectations for the S&P 500 Index (SPX), and this week touched its highest point since mid-December.

The VIX tends to rise when Wall Street is anxious, which is why many call it the “fear index.”

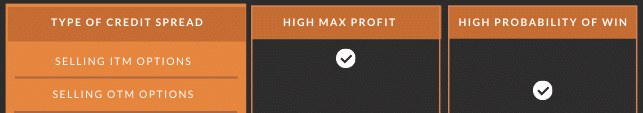

However, inflated IVs can be a boon for premium sellers like me, especially when you sell pretty close to in the money (ITM).

Of course, I target sold strikes that are pretty close to ITM because I believe my skill in selecting the right stocks and market direction will prevail, and I’ve been perfecting my chart analysis game for about 10 years over at Jason Bond Picks.

But by capturing those juicy premiums, I’m also assuming more risk.

That’s because ITM options are more likely to stay ITM compared to OTM or at-the-money (ATM) options — and premium sellers don’t want their options to stay ITM.

We want to capture that fat premium by selling the options, then watch it whittle down as the contract moves OTM, and ultimately close our position.

Nevertheless, if you are risk-averse, you can still put on similar trades and grab some healthy premium when IVs are high — you just have to be nimble and make some adjustments.

For example, let’s say Stock XYZ is trading around $446, and I expect it to go lower. Plus, IVs are high, which means a higher potential profit for option sellers.

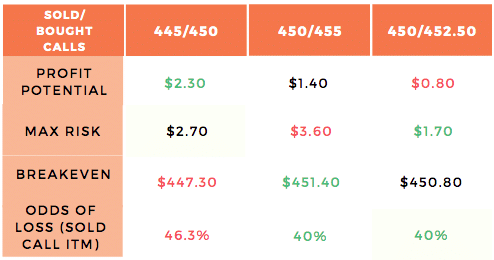

I go aggressive with my trade, selling the ITM 445-strike call for $17, and then hedging by buying the 450-strike call for $14.70, resulting in a net credit (aka – max reward) of $2.30 and a max risk of $2.70.

The probability of the 445-strike call expiring ITM is about 46.3%, so the odds are just slightly in my favor.

Breakeven on the trade is $447.30 (sold call strike + net credit).

Now, let’s say you also want in on the action, but prefer more favorable odds and don’t want to risk getting assigned.

By simply adjusting your strikes, you can boost your odds of a winning trade — but you’ll also have to sacrifice some potential reward.

For instance, in the same options series — with roughly two weeks to expiration — you could sell the 450-strike calls and buy the 455-strike calls for a net credit of $1.40 — the most you could possibly make.

Theoretical risk is higher here, at $3.60 (5-point difference between strikes, minus $1.40 net credit), but the odds of the sold 450-strike calls finishing ITM are much less, at around 40%, per a simulated trade on ThinkorSwim.

That’s good for you.

Breakeven is also higher than my trade, at $451.40.

Also favorable.

So, by being more conservative with your strikes, you’re giving up potential profits, and possibly assuming a higher risk, but the probability for a winning trade is also greater.

Another way to reduce risk is to narrow the gap between your sold and bought strikes, if at all possible. (It just depends on the specific stock.)

So, you could sell the 450-strike calls and buy the 452.50-strike calls for a credit of just 80 cents on the spread, with a maximum risk of $1.70. Breakeven would be $450.80.

In conclusion, guys and gals, don’t let unexpected market tremors keep you from trading.

The beauty of options is you can profit in ANY market environment — you just have to know how to be nimble and pivot.

[Ed. Note: Jason Bond runs

JasonBondPicks.com and TheWeeklyWindfalls.com. In 2015 he earned a 180% return on his money. Then in 2016 he turned a $100,000 account into $430,000! Discover How He Did It]

Source: TheWeeklyWindfalls.com | Original Link