Learn the roadmap that Jason Bond is using to aim for his best trading year in 2021.

— RECOMMENDED —

That’s All I Use Every Day to Locate My Favorite Opportunities. Learn Them Here!

Reserve Your FREE Virtual Seat To Jason Bond’s Exclusive Stock Trading Masterclass Here

Table of Contents

Small-Cap Watchlist – 4 Stocks That Can Retest Highs

What a way to kick off December.

Right now, no matter where I look, I see opportunities — if you can identify the right chart patterns and understand how to trade fast-moving stocks, it’s possible to uncover multiple hot trade ideas a day.

Of course, in this market environment, multiple sets of eyes are better than one.

That’s why I’m all about surrounding yourself with other traders, or at least talking to them to get fresh ideas.

Now, when it comes to these plays, it’s my bread and butter so that’s why I want to reveal to you four small-cap stocks that can pop off and retest highs soon.

4 Small-Cap Stocks To Keep On The Radar

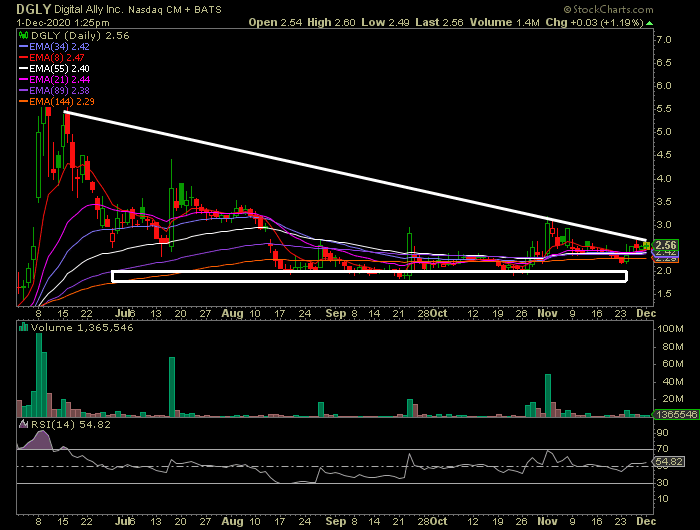

DGLY (Digital Ally)

- Digital Ally, Inc. manufactures digital security products for law enforcement agencies such as cameras built into the equipment like flashlights, vest systems etc.

- While DGLY is usually a go-to stock during times of social unrest, price action is indicating accumulation against 200 SMA. The stock is building a multi-month base between $2 and $3 area

- Float: 23M, Short Interest: 19% — relatively low float and high short interest points to a possibility of parabolic action, especially if it manages a close above $3.15

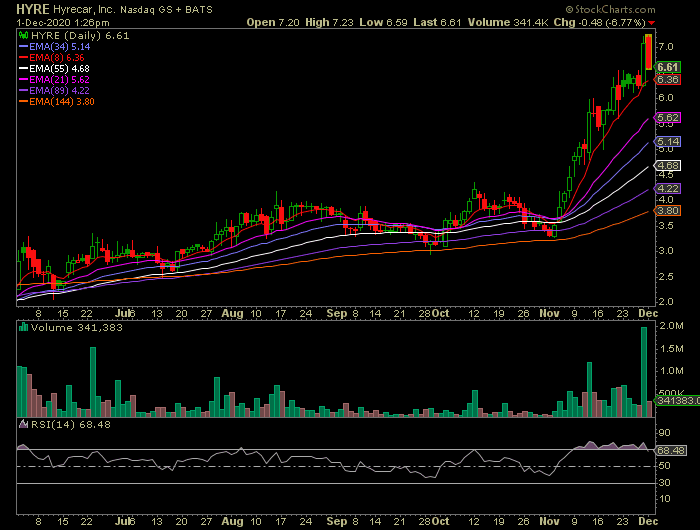

HYRE (HyreCar)

- HyreCar Inc. operates a car-sharing platform that allows car owners to rent their idle cars to ride-sharing service drivers in the United States

- HYRE just broke above its 52 week high and is now getting close to the all-time high of $8.03

- Float: 15.6M, Short Interest: 1.87% — while this one might not see fireworks tomorrow, it’s worth keeping an eye on

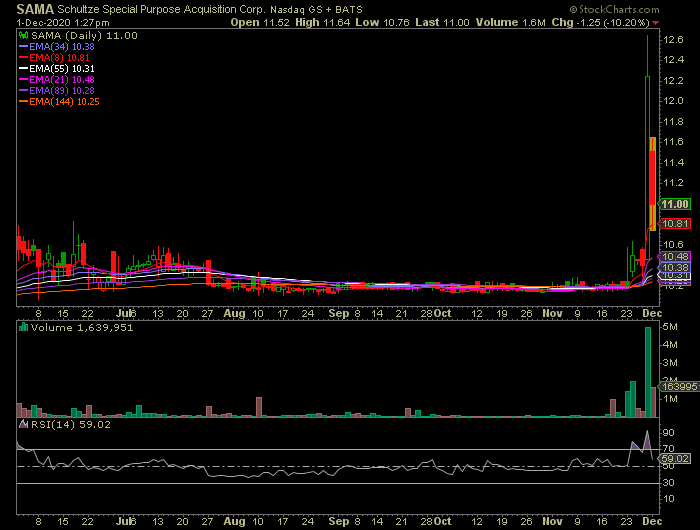

SAMA (Schultze SPAC)

- SAMA is a SPAC which will be merging with Clever Leaves, a cannabis pharmaceutical company serving customers worldwide

- SPACs have been gaining a lot of attention especially in hot sectors like EV and MJ stocks. SAMA is new weed play in the market which is poised to stay in play for the foreseeable future

- Float: 13M, Short Interest: 0.51% — even though float mechanics are the same between traditional equities and SPACs, the sector of the underlying business matters most for SPAC performance

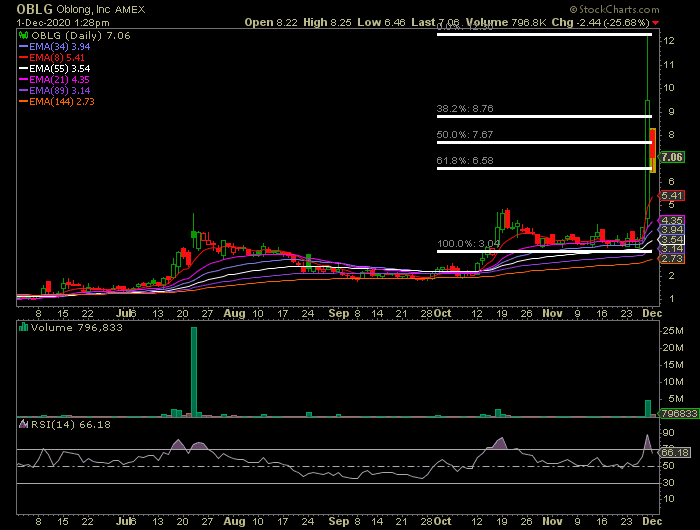

OBLG (Oblong)

- Oblong, Inc. provides video communication software solutions such as multiple streams sharing, common meeting tools, and wireless voice solutions for customers worldwide

- OBLG popped 133.42% from $4 to $12.25 on Monday on no significant news, but has since pulled back. The Fibonacci retracement levels look interesting here.

- Float: 4.8M, Short Interest: 4.5% — the float of OBLG is truly tiny which can lead to explosive moves

There’s so much action in the market, and I want to show you the three reasons why I believe I can position myself to have my best trading year in my career in 2021.