As someone with a small account, one of the most difficult obstacles to overcome is the Pattern Day Trader (PDT) Rule. It states that if your account is under $25,000, then you are limited to 3 round-trip day trades in a 5 day period.

In other words, if you are trading a small account, and you want it to grow fast, like what I’m doing with my Small Account Challenge, then you’ll have to change the way you trade so you aren’t labeled a “pattern day trader”…

You see, if you are labeled a “pattern day trader” by your broker, they may decide to “freeze” your trading account for upwards of 90 days.

That said, the trading strategies that I teach my clients are built specifically for avoiding the Pattern Day Trader Rule while trading a small account.

I will show you how to capture great returns in your small account with a couple of techniques I use to avoid being labeled as a pattern day trader…

Table of Contents

Day Trade without the Label

If you have a small account… you’ve probably heard of the dreaded Pattern Day Trader (PDT) rule.

Basically for your own “protection,” if you have an account with under $25K… then you can’t day trade.

The rules are based on the fact that so many people lose their shirts trading… but the fact is, it doesn’t matter if you have a small account or big account, most people lose their shirts.

Regardless, this creates a barrier for you when trying to make money trading.

But you are in luck because I have created a system that gets around the PDT rules and it makes a lot of money…

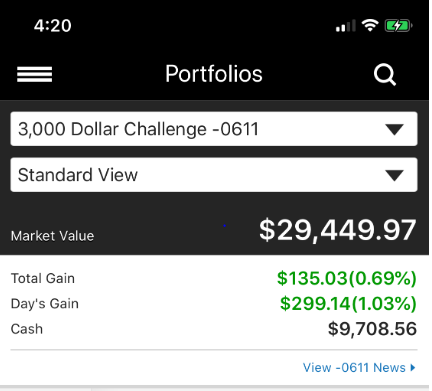

I started my last small account challenge June 14 with just $3k and in just 4 months reached my goal of 25k… in fact, at the close of trading 10/25 my account was over $29k.

Now it’s time to start over… so I will be starting my next small account challenge with a fresh account value around $3-5k and grow it back up again… (be there from the start)

And I do this while avoiding the PDT rule.

How the PDT Rule Affects Your Trading

With a small account (under $25K), you can only day trade three times in a five-day trading window.

For example, let’s say you buy a stock at 10:00 AM and sell at 3:00 PM… that’s considered a day trade… and if you do that three times within one business week… then you risk being locked out of your account.

If you don’t have a trading style that allows you to work around this rule… and you focus on quick profits… your account can actually get locked.

You see, the consequences of placing more than three day trades are your account can get frozen for some time… causing you to miss out on opportunities.

However, I’ve figured out how to avoid this rule altogether.

End of day trades – Supernova BOOST

For the most part, I use my easy-to-find chart patterns to find trades that allow me to avoid the PDT rule.

For example, I have some specific setups that allow me to buy stocks at the end of each trading day… and then sell the next morning to lock in profits.

You see, if you buy a stock one day… and sell the next… it’s not considered a day trade. For example, let’s say I buy a stock at 3:45 PM… and I sell it the next day at 9:45 AM…

I’ve worked around the PDT rule… even though I would be selling under 24 hours from when I bought the stock… it’s not considered a day trade.

Here’s what I’m talking about…

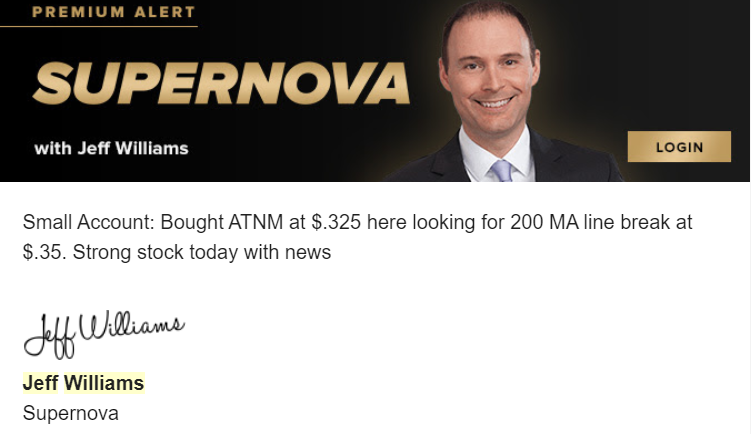

I spotted Actinium Pharmaceuticals (ATNM) breaking above my Supernova Line.

This was one of my end of day Supernova BOOST trades… and you can learn more about it here.

The stock broke above my Supernova Line, volume was confirming, towards the end of the day, the stock was showing me what I wanted… and at 1:50 PM I bought shares of ATNM.

Now, the very next morning at 9:58 AM… I locked in a gain of $1,010 very quickly… but I got around the PDT rule, while doing it…

The other way I get around the PDT rule… by simply limiting the number of day trades I take per week.

If you have an account under $25K, and if you read between the lines… you could still day trade… you just can’t make it a habit.

You see, you can actually place three day trades within five trading days. That means you can have day trade, you just need to stay at the limit.

For example, sometimes one of my small account trades just takes off to my target right away…

You better believe I am going to take my profit. And this will be one of my 3 for the 5 day period. When my strategy is set to take stocks overnight for big moves the next morning, I don’t have to worry about running into a large number of day trades…

So when it does happen, I take the profits and keep trading my strategy.

For example, here’s a look at this setup I liked for an end of day Boost trade:

I bought shares based for a price target to a little over $2, thinking I could see it the next trading day…

Well, we got a squeeze and it popped up to my target in about 5 minutes and what did I do?

I took $1300 in profits… If you want to learn more about this strategy, Click here.

Don’t let a small account and the PDT rule keep you from profiting in the stock market. As long as you have the right strategies, you won’t have to even worry about it.

Source: PennyPro.com | Original Link