But the words coming out of their mouths don’t quite match their actions…

That’s why, today, I want to introduce you to my right-hand man and lead analyst, Greg Wilson.

You see, what most people aren’t seeing is that these Wall Street giants are quietly changing their tune. They’ve started hoarding cryptos… And, as Greg will show you, that could send the whole market soaring sooner than you expect…

***

“I could care less about Bitcoin.”

That was Jamie Dimon—the CEO and president of JPMorgan Chase—speaking this past October at the Institute of International Finance

He went on to say that governments would crush Bitcoin one day.

Dimon has a long history of trashing Bitcoin whenever he gets the chance.

In 2014, he said he wasn’t a fan because Bitcoin was “being used for illicit purposes” and that it was a “terrible store of money.”

Then in 2015, Dimon said, “You’re wasting your time with Bitcoin.”

And in 2017, he famously called Bitcoin and digital currencies a “fraud.”

With comments like that, we would excuse you if you thought JPMorgan hated cryptocurrencies.

And he’s not the only one. But like a lot of things with Wall Street, you should take what it says with a grain of salt…

… especially because there’s a new crypto narrative coming out of Wall Street.

And you need to act now, before it reaches the masses.

Table of Contents

Wall Street Hates Cryptocurrencies

Many Wall Street executives have shown their disdain for cryptocurrencies.

Take Ray Dalio, for example. He’s the founder of the world’s largest hedge fund, Bridgewater Associates.

He recently said Bitcoin was a bubble and too volatile to be an effective store of wealth.

Larry Fink was equally dismissive. Fink is the CEO of BlackRock, the largest asset manager in the world. The firm has nearly $5 trillion in assets under management (AUM).

According to Fink, “Bitcoin just shows you how much demand for money laundering there is in the world.”

UBS Chairman Axel Weber is skeptical as well. UBS is a worldwide investment bank with nearly $1 trillion AUM.

When asked about his skepticism, Weber stated, “It probably comes from my background as a central banker.”

Weber likewise doesn’t think Bitcoin can be a means of payment or a store of value.

The list goes on… but you get the point.

Wall Street has made it obvious that it thinks very little about Bitcoin and cryptocurrencies.

The answer why is obvious: Bitcoin and cryptocurrencies are a threat to the fat profit margins of traditional finance. You can send a million dollars across the Bitcoin network anywhere in the world and it will cost you just a couple of dollars. A million-dollar wire sent via a bank overseas costs about $70 and takes 3–5 days… Plus, you’ll lose 1–3% in the currency conversion.

That means if you live in the UK and I send you a million dollars via a bank wire, you’ll actually get the equivalent of $970,000–990,000. You will lose $10,000–30,000 in foreign exchange fees. With Bitcoin, you can do the same transaction, pay a couple of bucks in network fees, and get your money in 10 minutes.

Banks make hundreds of billion of dollars in profits from overseas wires… and Bitcoin could wipe those profits out. No wonder the big banks are trashing Bitcoin.

If you listened to the advice of bankers, you’re likely sitting on the sidelines.

But that’s a mistake. Because behind the scenes, Wall Street is secretly embracing Bitcoin and cryptocurrencies.

And a new narrative is emerging.

JPMorgan and the “Bitcoin Bible”

On February 9 of this year, JPMorgan released a new research report on digital currencies titled, “Decrypting Cryptocurrencies: Technology, Applications, and Challenges.”

But some are calling it the “Bitcoin Bible.”

If you thought the report would state all the reasons why JPMorgan is against cryptocurrencies, you’d be wrong.

The report came to some startling conclusions—notably, that cryptocurrencies “are unlikely to disappear.”

That will likely surprise many who have just kept tabs on the headlines.

We found this conclusion most noteworthy:

If past returns, volatilities, and correlations persist, cryptocurrencies could potentially have a role in diversifying one’s global bond and equity portfolio.

That’s huge news, because it suggests that what we’ve known all along: Bitcoin and cryptocurrencies have real-world value. This is why—secretly, behind the scenes—we are seeing institutions like JPMorgan and Goldman Sachs that have publicly slammed Bitcoin now actually buy it.

You Heard It Here First

We can’t prove this… but what we think might be happening is that institutions could be quietly snapping up Bitcoin on the cheap so they can later recommend it to their clients. If we’re right, they’ll make a fortune selling their cheap Bitcoin to their customers at much higher prices.

We’ve been following this trend since December.

Here’s what we wrote then…

We envision Wall Street’s pitch will be that, by allocating 5–10% of your portfolio to Bitcoin and other cryptocurrencies, you can actually bring down volatility. That’s because Bitcoin is unaffected by crashes or booms in the stock, bond, oil, or gold markets.

Wall Street has a history of using stories, called “narratives,” to drive its investment decisions.

Remember the internet “New Era” narrative and the housing “plateau of prosperity” narrative?

We also pointed out research that showed Bitcoin is uncorrelated to other assets. That means the price movements by other assets, such as stocks and bonds, don’t affect Bitcoin.

And that’s big for Wall Street.

It’s realizing that adding Bitcoin to its portfolios will give it better risk-adjusted returns— meaning, better returns with less volatility.

And that’s the new narrative JPMorgan and Wall Street will be pushing going forward.

What It Means for You

Consider for a moment if Bitcoin and cryptocurrencies become part of global bond and equity portfolios.

The global stock and bond markets total $288 trillion.

Just a 1% allocation means nearly $3 trillion coming into the cryptocurrency space. That’s 12 times more than the entire space right now. Our best guess is that this is what the institutions are banking on—and they’ll make a fortune from it.

Today, you have an opportunity to still get in at the prices they are getting in at. The time to buy is now, before Wall Street makes the switch and starts publicly embracing Bitcoin.

Act now—Wall Street is.

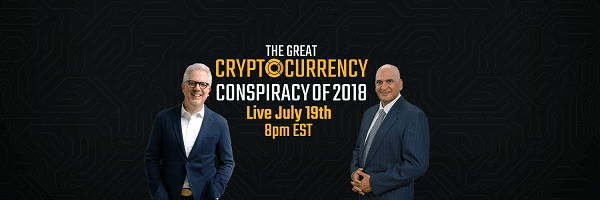

FREE training webinar with Glrnn Beck and Teeka Tiwari

If you want to be part of this trend, we suggest you get started by buying a bit of Bitcoin. It’s the most widely used cryptocurrency.

But if you’re interested in learning how to turn small, $100–500 stakes into outsized gains by trading smaller cryptos… tune in to the FREE training webinar Glenn Beck and I are hosting on July 19, where I’ll be sharing the names of three cryptocurrencies you should buy immediately.

We’re calling it: The Great Cryptocurrency Conspiracy of 2018. And we’ll be giving away $2 million worth of Bitcoin.