This market is driving me bananas!

And as a trader, the best thing you can be – IS HONEST WITH YOURSELF.

My bread and butter TPS setups on the daily time-frames aren’t giving me the number of wins I’d like to see.

It’s something that I encountered before. That’s why I’m not scrambling to learn a new strategy and dump the one that’s changed my family’s life forever.

However, that doesn’t mean I’m not looking to make adjustments – because I am.

If you can’t identify what’s a bad trade and what’s a garbage strategy, you’ll end up chasing the last winner over and over until you’re broke.

Let me explain how to separate the two.

Regardless of your experience, you need to start recording…

Make your trade journal your best friend!

Your journal contains everything you need not just to separate failing strategies from failing trades – but strategies that make you money.

Table of Contents

The Unprofitable Trader

Problem – I had one big winner and a few small winners. Which should I be shooting for?

Most traders fall into two categories: Babe Ruths and base hitters. Babe Ruths swing for the fences every time. The Babe struck out a ton. But, he also hit a lot of home runs. What made him valuable was that his big hits outweighed his losers.

Traders with this style tend to have low win-rates. They aren’t necessarily speculative bettors. The key for them is that their wins outweigh their losses. This strategy requires a bankroll large enough to the trade size that allows you to execute enough trades that the averages play out over time.

Base hitters work by making consistent trades. They rely on a narrow risk-reward ratio and focus on kicking up their win-rate. Traders like this will often use mean-reversion trades or other high probability strategies.

Solution – Focus on becoming a base hitter

Our emotions will push us to become Babe Ruth’s. It satisfies the guilty urge we have to make a lot of money very quickly.

The problem is that strategy is extremely tough to work with when you’re starting out. It requires a lot of trades in a lot of market conditions to collect enough data to determine whether the strategy works out over the long-haul. Unless you’re fine being in a demo account for a year or more, it’s a tough pill to swallow.

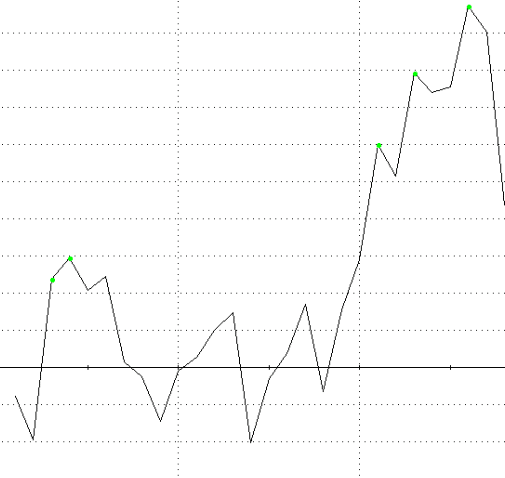

This is what your equity curve might look like under this strategy:

Babe Ruth Equity Curve

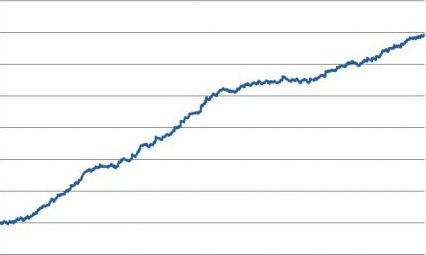

Working on your win-rate will get you into the game faster and make it easier to determine whether the trade or strategy is failing. Base hitters should see a consistent equity curve heading up and to the right as each trade is executed, akin to something like this:

Consistent Win-Rate Equity Curve

The Breakeven Trader

Problem – It seems like certain times of day, or periods in the year are difficult to trade

If you haven’t done it before, watch the market during the first 30 minutes of the trading day. The first 15 minutes are especially crazy. Market volume dries up a lot right before holidays. Stocks have their heaviest volume during earnings.

Each market and stock has its nuances. The question is whether these different influences actually matter to you.

Solution – Define your strategy style

The quick fix is categorizing your type of trading. If you do scalps, seasonal influences won’t matter, but the time of day will. Swing traders need to be aware of the broader market as well as earnings in similar stocks.

For example, earnings results in one semiconductor name could impact all the other semiconductors.

Categorizing your trades is only the first step. The second is to label the influences. That lets you separate the ones that matter from those that don’t. You might even be surprised to find a few that you don’t commonly look at matter quite a bit. Search around and make a list first before evaluating whether they’re important.

The Profitable Trader

Problem – Strategy stops producing trades

Everyone goes through a lull in their trading. Unless you have multiple strategies that you trade at the same time (which I do not recommend until you’ve got your first one set and profitable), you’ll come to a point where you can’t seem to find any trades.

This comes from three problems: you’ve gotten complacent, your strategy only works under certain market conditions, or your strategy is bunk.

The first one is easily correctable. The second is easy to identify. The third takes a little analysis.

Being complacent happens to all of us. The best traders actively look for it. Most rely on evidence that proves to yourself you missed trades.

That’s where your trade journal and historical charts come in. One part of journaling is noting what setups you pass on. It doesn’t have to be as detailed as your actual trades, just something that lets you know where to look back.

Additionally, you want to go back through stocks within your typical trade parameters that you haven’t scoped out. Look at their charts and see if you missed any setups.

The idea here is to either prove to yourself that you did your due diligence or you didn’t do enough. Most of the time, you’ll find you just missed setups. Remember, looking for setups takes practice too.

Now, let’s say you didn’t miss any setups. You’re faced with figuring out whether your strategy got lucky or only worked in certain market conditions. There are two ways to see which is right.

First, review your trade journal. See whether the trades you took are all under the same or different market conditions. The second is to go back through a period in the market that you know has different conditions and try to find setups.

Both of these will be able to show you whether your strategy works in different environments. Keep in mind, there is nothing wrong with a strategy that works only in one environment. It just requires more patience.

It’s all about minor adjustments

Once you find your strategy, you don’t want to make massive overhauls. Tiny tweaks work just fine. If you find your strategy works and only gives you limited trades, feel free to start another one.

A lot of the time it helps people to understand how I developed my TPS Strategy. I have a webinar that explains how I first started and then narrowed down my focus.

You can click here to learn more.

Source: Weeklymoneymultiplier.com | Original Link