Table of Contents

Weekend Wiretap system Live Training

This Thursday, March 12th at 8pm ET, Jeff Williams (RagingBull) is hosting a live event.

He developed a proprietary trading system that allows him to profit more than 5 days a week, and no, he doesn’t have a time machine.

He just has his Weekend Wiretap system!

By placing this one trade on Friday that rolls over into Monday, Jeff Williams learned to put all 7 days of the week to work for his account.

Last week’s Weekend Wiretap trade net him a cool $6,800 on BIOC.

He placed the trade on Friday afternoon, and cashed out Monday morning.

A 4 day hold time and zero maintenance on the weekend.

Weekend Wiretaps Live Webinar – Watch it LIVE Here

Three Ways To Avoid PDT

One of the most enormous obstacles that small account traders face is the Pattern Day Trader Rule. It states that if your account is under $25,000, then you are limited to 3 round-trip trades every 5 days.

In other words, if you are trading a small account, and you want it to grow fast, like what I’m doing with my Small Account Challenge, then you’ll have to change the way you trade so you aren’t labeled a “pattern day trader”…

You see, if you are labeled a “pattern day trader” by your broker, they may decide to “freeze” your trading account for upwards of 90 days.

That said, the trading strategies that I teach my clients are built explicitly for trading a small account, and avoiding the Pattern Day Trader Rule. I’ve actually turned these so-called limitations into strengths.

I’m not kidding.

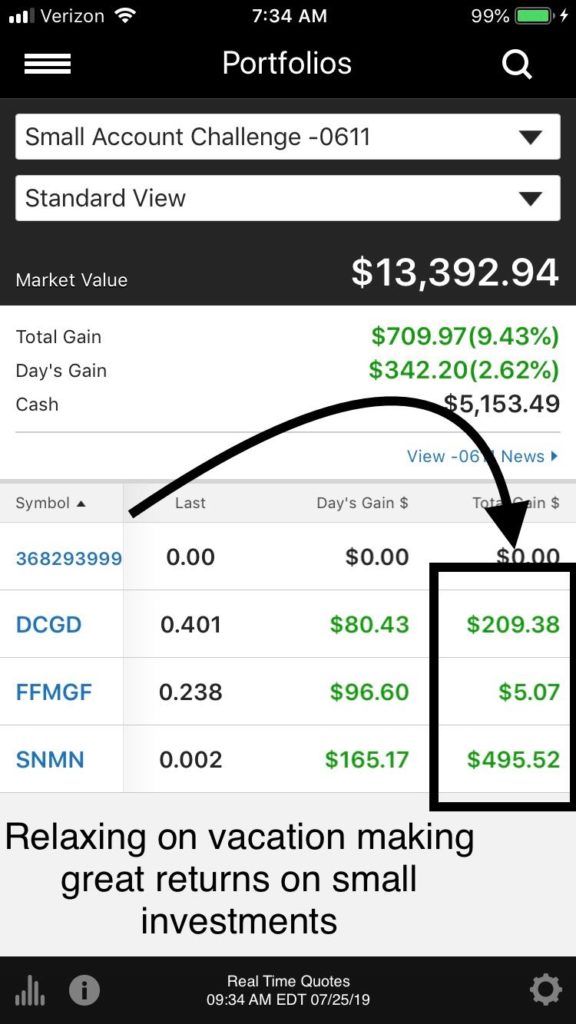

Over the last five weeks, I’ve been not only able to avoid being labeled a pattern day trader, but my trading has thrived, as I’ve taken my $3K account and flipped into $13K.

I’m going to walk you through 3 crucial steps you must take to avoid being a pattern day trader. You’ll also learn about some of the trading techniques I am using to return over 300% in five short weeks.

Hacking The One Rule Holding You Back

If you have a small account… you’ve probably heard of the dreaded Pattern Day Trader (PDT) rule.

You see, if you have an account with under $25K… then you can’t day trade.

Now, a lot of people think just because you have a small account and can’t day trade… you can’t make money in the markets.

False.

How do I know?

Well, I’ve been taking on the Small Account Challenge and trying to turn $3K into $100K.

That means I can’t day trade yet. However, I’ve been able to grow that account to $12,710.52 so far… and I started this new challenge just a month ago.

(You still have some time to witness me grow this small account… but you’ll have to join now to see exactly how I’m doing this.)

I did that all without the day trading… and avoiding the PDT rule.

How the PDT Rule Affects Your Trading

With a small account (under $25K), you can only day trade three times in a five-day trading window.

For example, let’s say you buy a stock at 10:00 AM and sell at 3:00 PM… that’s considered a day trade… and if you do that three times within one business week… then you risk being locked out of your account.

If you don’t have a trading style that allows you to work around this rule… and you focus on quick profits… your account can actually get locked.

You see, the consequences of placing more than three day trades are your account can get frozen for some time… causing you to miss out on opportunities.

However, I’ve figured out three ways to avoid this rule.

1) Buy Today, Sell Tomorrow

For the most part, I use my easy-to-find chart patterns to find trades that allow me to avoid the PDT rule.

For example, I have some specific setups that allow me to buy a stock one day… and sell the next day to lock in profits.

You see, if you buy a stock any time one day… and sell the next… it’s not considered a day trade. For example, let’s say I buy a stock at 3:45 PM… and I sell it the next day at 9:45 AM…

I’ve worked around the PDT rule… even though I would be selling under 24 hours from when I bought the stock… it’s not considered a day trade.

Here’s what I’m talking about…

I spotted this chart in Tautachrome Inc. (TTCM).

This was just a bullish setup that I call the Staircase to Profits… and you can learn more about it here in the Stock Trading Starter Pack.

I waited to see the price action into the close… and at 3:18 PM I bought shares of TTCM.

Now, the very next morning at 9:34 AM… I locked in a 15% on the same trade and got around it.

2) Swing Trade

Now, you could also buy and hold stocks to avoid the rule.

What I mean by that is buying a stock and holding it for a few days or weeks. Basically, when you swing trade… you want to identify the trend before it happens, buy the stock, and just ride the waves.

For example, let’s say you think Bitcoin stocks are going to be hot for a week. Well, you could actually spot a bullish pattern… develop a trading plan… then just buy the stock for a few days or weeks until the move happens… or you stop out.

Here’s a look at one example of a swing trade.

If you bought shares of Overstock.com (OSTK) when it broke above the 20-day simple moving average (SMA)… and planned to hold it until it hit the 200-day SMA.

Well, you would’ve held the stock for a few weeks… locked in large profits… and avoided the PDT rule.

Now… there’s a third way to avoid the PDT.

3) You Can Still Day Trade With the PDT

If you have an account under $25K, and if you read between the lines… you could still day trade… but you just can’t make it a habit.

You see, you can actually place three day trades within five trading days. That means you can have a day trading strategy to supplement your swing trading and overnight strategies.

However, you just have to limit the number of day trades.

For example, sometimes I’ll day trade… if I place one trade, I’ll mark it down so I know when I day traded and how many times. Once I mark down that I placed three day trades… I look to my other strategies.

When I day trade… the profits are quick… so even if I do it 3 times in a week, it adds up.

For example, here’s a look at a setup I liked:

I bought shares based on this chart pattern… and took ~$300 in profits, in just about 10 minutes. If you want to learn more about this trade, read about it here.

Just because you have a small account… you shouldn’t let that stop you from learning how to trade and build the stock. You see there are some workarounds for the pesky PDT rule… as long as you have the right strategies, you probably won’t ever need to worry about it.

Bonus: Weekend Wiretaps

I’ve actually been holding out on you… there’s another way to avoid the PDT rule… and I call it Weekend Wiretaps.

It’s actually one of my latest strategies, only offered to my Supernova clients…

… and it’s been able to pull profits like these recently: