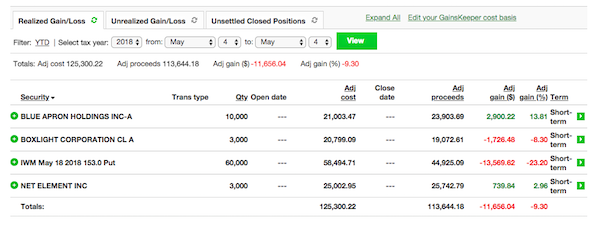

-$11,656.04 Friday, mostly on an IWM put that didn’t go my way. I thought the market would head lower, break trendline support and deliver a big win, but AAPL carried the day and pulled small caps with it. In general I’m very excited about the action in the IWM, if this ascending triangle breaks the supply line (resistance) at $160 we’ll start to see small caps trend like we did in 2017 and that generally makes for easy swing trading.

I’m +$160,261.92 in the last 6-weeks trading part time and using some of those profits to take a vacation with Pamela and Noah at Beaches Turks & Caicos.

—– Related —–

Swing trading on vacation is my favorite. I’m usually able to fund the entire vacation while on vacation with limited effort, this is the true power of my strategy at work, let’s see how this week goes.

As noted above, the IWM is working this ascending triangle perfectly and if it breaks above $160 I’d expect the volatility that’s been a big part of the market for over 2-months to subside and make swing trading lucrative. After Friday’s big move up and Monday’s futures green too, I think it could be in the next 2-weeks so I’ll be active with my swings until that trendline fails.

No updates to my long-term positions LQMT and ROX. I’ll keep you posted if something changes.

Here’s the swing trade watch list to start the week.

MOSY – Ascending triangle continuation pattern with big upside potential to $2ish and a history of huge spikes recently on the chart. I like it above $1.40 for a swing this week.

RETO – Already holding 7K shares basically even and looking for $1 – $2 / share into this oversold bounce. Fundamentally strong company, recent IPO at $5 and history of 50-100% moves in short periods of time attracted me to the stock. Coming out of oversold with the MACD headed for a crossover leads me to believe it could start to move soon.

Watching Fibonacci retracement on CLWT, BOXL, IMTE and CREG. Lots of momentum stocks starting to pop up again which is a good sign I might be right about the IWM ascending triangle breakout. If you’re new to Fibonacci setups they are not or undisciplined traders, you need to go into these trades with a plan and take your losses if the pattern fails, otherwise they can turn into huge bags. However, if you study my lessons in How To Trade Like A Pro on Fibonacci, these can deliver huge scores fast and compound a portfolio very quickly.

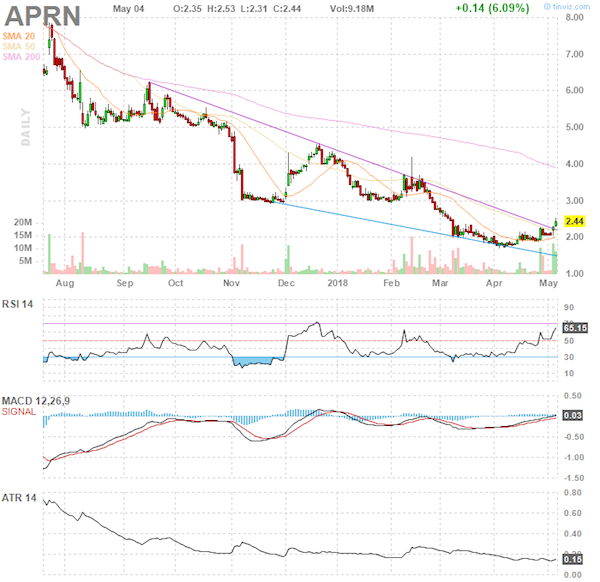

APRN – Hit a nice win on this recently and looking to get back in around $2.30’s and trade for the upper $2’s on a swing. The company is turning things around, thanks to the new CEO and remains a buyout target at these levels.

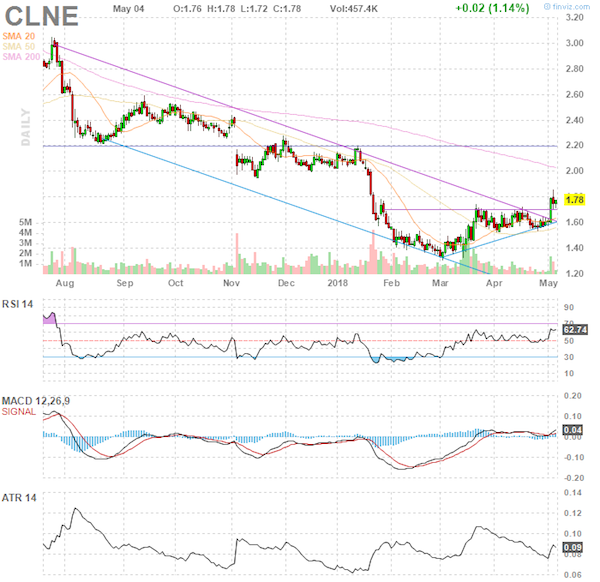

CLNE – Nice ascending triangle breakout last week on heavy volume should leave $1.60 as support with range to $2 for profit. History of big news spikes also makes this reliable pattern exciting to be in overnight.

[Ed. Note: Jason Bond runs JasonBondPicks.com and is a swing trader of small-cap stocks. In 2015 he earned a 180% return on his money. Then in 2016 he turned a $100,000 account into $430,000! Discover How He Did It]