Marc Chaikin reveals his Chaikin Power Gauge. The Power Gauge is a system that gives you the chance to double your money by predicting tomorrow’s stock ratings on Wall Street – today – in any market.

Marc Chaikin’s Power Gauge FREE Access – Click Here

Table of Contents

Marc Chaikin: How I built the Power Gauge?

It’s incredible how much you can learn by taking a little time to study charts and track trends in the markets.

Even to this day, some people still think of technical analysis as some sort of “voodoo.” But deep number analysis is what shaped my investment philosophy over the years…

It’s also how I built the “Power Gauge” that I talked about yesterday. And starting today, I’d like to take some time to walk you through exactly how it all works…

You’ll see that it’s not voodoo at all. Instead, it’s an objective way to look at any stock you would like. And most important, it’s how you can quickly learn if it’s time to invest or time to walk away…

The Power Gauge is a quantitative tool

Overall, it looks at 20 different factors. By analyzing each of these factors in real time, it gives readings on thousands of individual stocks – from “very bullish” to “very bearish.”

We break the 20 factors in the Power Gauge into four main groups…

- Financials

- Earnings

- Technicals

- Experts

— RECOMMENDED —

If you’re concerned about the supply shortages… backlogged ports… inflation… or even the “aging bull market” – pay close attention. Because there’s an EVEN BIGGER wrecking ball you need to be watching out for. Stansberry’s newest analyst is gearing up to show you why…

This story is something you can’t afford to miss.

Let’s begin with financials

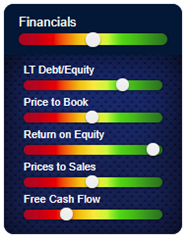

This group is made up of five factors that give us insights into both the financial health and current valuations of a company. You can see those five factors in the graphic below…

First up is the “long-term debt to equity ratio”… This factor is simply a comparison of a company’s long-term debt to its shareholder equity.

Generally, you want to see a low ratio. That means a company doesn’t have a lot of debt – and therefore, a big interest-expense burden – relative to the assets that it holds.

Next up is the “price-to-book ratio.” This is a valuation tool that compares a company’s book value (a rough estimate of its assets) to its share price. Like all valuation tools, a lower price-to-book ratio is better.

Our third factor in this category is “return on equity”… In short, it gives us a glimpse into a company’s operating effectiveness.

Specifically, it’s a ratio of a company’s net income and shareholder equity. In other words, it’s how much money a company makes compared to its net asset base (total assets minus debt).

We want to see a higher ratio… That tells us the company is effective at making money.

The fourth factor is another valuation tool… It’s the “price-to-sales (P/S) ratio.” This ratio compares a company’s share price with its total revenue.

We always want to pay a low price when investing. And looking at the current P/S ratio lets us know if we’re paying too much for $1 of revenue with a particular company.

Our last factor in the financials category is “free cash flow.” This is the cash earnings left over after a company pays for any real cash expenses – like operations and maintaining assets.

This is one of the few items on the income statement that accountants can’t mess with… So you can’t fake it. It only looks at cash that comes in versus cash that goes out. We ignore any noncash expenses.

Simply put, if a company has a lot of free cash flow, it’s likely in a strong financial position.

By combining these five factors, we’re able to come up with an overall reading for the financial strength of a company. And of course, we want to find companies in the best financial shape possible.

Marc Chaikin’s Power Gauge FREE Access – Click Here

Next major group of factors in the Power Gauge is earnings

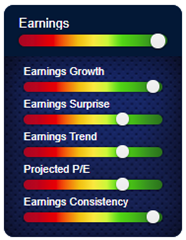

Once again, this portion of the Power Gauge looks at five factors.

These factors give us powerful insights into the current earnings of a company. But it’s not just that… It also helps us to see the trends in those earnings and where they’re headed.

You can see all five earnings factors in the following graphic…

In the earnings category, the first factor is “earnings growth.” This factor is pretty straightforward… We want to see a company’s earnings moving higher. It shows us that a company is not only in a strong position, but it’s getting stronger.

Next, we look at “earnings surprises.” That’s simple to understand, too… When a company outperforms what analysts expected, it’s a good thing – an earnings surprise.

Seeing a company beat earnings tells us that the underlying business is in better shape than the experts believed. And beyond that… a string of positive earnings surprises also indicates that the business trends are in our favor.

Our next factor is the “earnings trend.” This supplements the longer-term growth factor by honing in on the recent past.

Specifically, we want to see earnings in a strong upward trend. That means this company is performing better than last year… and that the three-to-five-year trend is likely still in place.

The fourth factor in this category is the “projected price-to-earnings (P/E) ratio.” This is a valuation tool that compares the current price of a company to its earnings.

The ratio takes into account a company’s future earnings. So this tool not only shows valuation… it also looks at a company’s future prospects to determine that value. Like our other valuation tools above, we like to see a smaller projected P/E ratio.

Our last earnings factor is “earnings consistency.” This factor tells us how much variability exists in a company’s earnings…

You see, some businesses can experience wild swings with their earnings from one quarter to the next. That’s often dangerous for investors. Instead, we prefer to see consistent (and growing) earnings before we invest.

Between the financials and earnings groups, we can gather a good overview of a company’s health…

But the work isn’t finished… There’s still a lot to look at through our Power Gauge.

On Saturday, I’ll walk you through the rest of our factors… We have 10 factors remaining in two major categories. You’ll see that taking a technical and quantitative approach to investing doesn’t have to be difficult.

But before we close today, I know what you may be thinking…

Marc Chaikin’s Power Gauge FREE Access – Click Here

Marc Chaikin’s Prediction 2022: FREE Access To Chaikin Power Gauge

I understand if you’re asking that question in your head right now. Most folks who come out of retirement to build a proprietary model don’t then tell you exactly how it works.

That logic misses the point, though…

You see, while building the Power Gauge, I’ve learned that the 20 different factors matter… But something else is more important.

Say I make you dinner and give you a list of all the ingredients I used. The scratch-made pasta had flour, eggs, and salt. The sauce included tomatoes, garlic, onions, and oregano.

That’s all I tell you, though… I don’t give any further instructions on how to make it.

Do you think you could recreate the meal exactly as I did? I’m not talking about making something close to what I made… I’m talking about really nailing it – an exact replica.

If you’re a trained chef, maybe you could do that. But we all know there’s a lot more to recreating a final product then simply knowing the list of ingredients that go into it.

The Power Gauge is the same way…

The 20 quantitative factors are important. Without them, the Power Gauge doesn’t exist. But the key to pulling the whole “meal” together is their specific weighting in the process.

I keep that part of the process under wraps… It’s proprietary information that allows me to safely share the list of Power Gauge ingredients with anyone who asks.

The great news is that with the Power Gauge, you don’t need to worry about the recipe. You can use the model very simply… Just plug in the stock you’re interested in and off you go.

That exciting reality is why I’m hosting a special event next Tuesday night, May 25, at 8 p.m. Eastern time. It’s the first time I’ve ever done something like this…

I’m planning to shed more light on the Power Gauge and explain how you could have used it to make 884% in eight months on NIO (NIO) last year… 335% in two months on Novavax (NVAX)… 799% in nine months on Fulgent Genetics (FLGT), and more.

This is the same type of data that got me invited to ring the opening bell at the Nasdaq… and convinced multibillion-dollar hedge funds run by George Soros, Paul Tudor Jones, and Steve Cohen to become my clients.

The event is free to attend, but you need to sign up ahead of time.