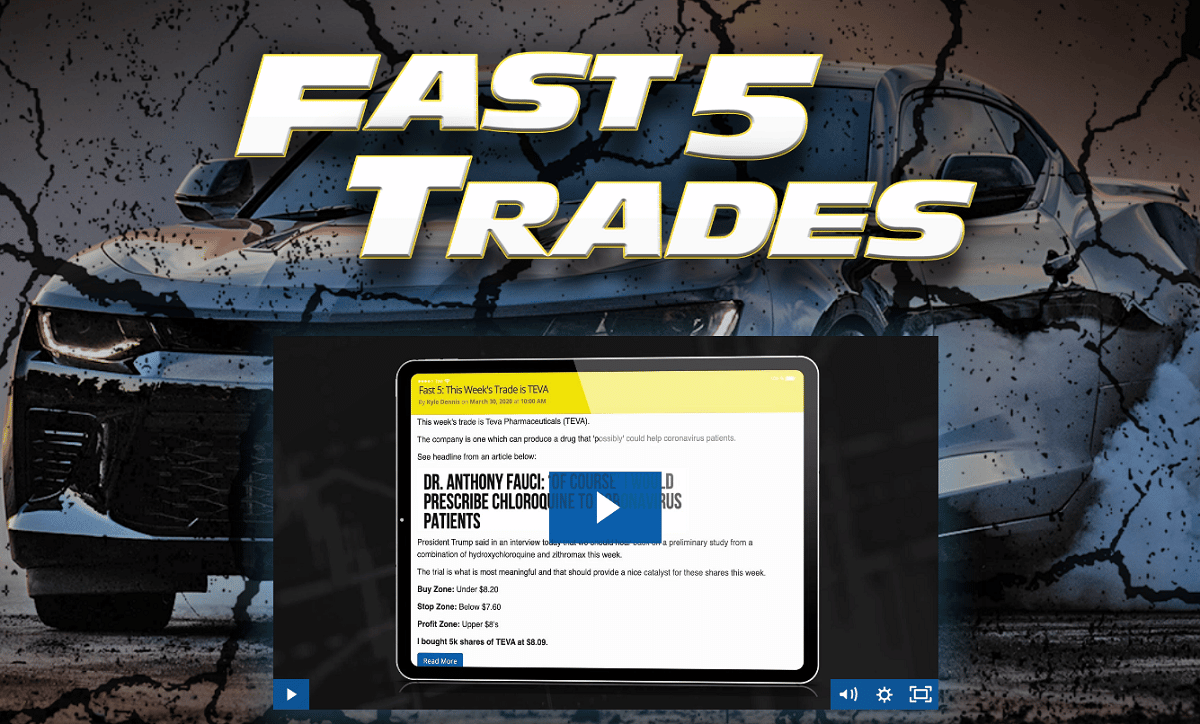

Kyle Dennis FAST 5 Trades: What is a Stock Sympathy Play & How to Use

Kyle Dennis FAST 5 Trades Training. Kyle Dennis reveals What is a Stock Sympathy Play & How to Use. Kyle Dennis has profited an extraordinary $4.1 Million Dollars during 2020. Want to learn Kyle’s favorite method to use these crazy market conditions to his advantage?