The last 72 hours brought us tighter border restrictions, a series of US deaths, and an admission that it’s not a matter of if…but when the Coronavirus outbreak hits our country.

This week’s Jump starts where the market decline ended – a global pandemic.

Here’s a quick recap of notable events:

- 86,022 infections and 2,942 deaths bring the mortality rate up from 2% to 3.4%, putting it more in-line with SARS.

- South Korea cases jumped to 3,150, 1,128 in Italy, 593 in Iran, and 241 in Japan.

- Five Iranian government officials tested positive for the disease, showing the virus cares little about social status.

- Washington state was hit with its first case while California found the first infection from an unknown origin.

- The FDA authorized private labs to develop tests after a bungled rollout from the CDC earlier in the week.

- 3M is producing surgical masks to help prevent the spread.

- Companies around the globe can’t yet quantify the impact of their broken supply chains.

- Federal Reserve officials stood ready to cut rates to help markets.

When you lay it all out there against stretched valuations, is it any wonder the market cracked like an egg?

— RECOMMENDED —

THE WINNING STRATEGY THAT WALL STREET HAS BEEN HIDING FROM EVERYONE…

Table of Contents

Major Markets Unwind

A pullback was inevitable. But, with passive investing at all-time highs, last week was more than a normal selloff. What we saw was the forced liquidations and major unwindings of positions.

How do I know?

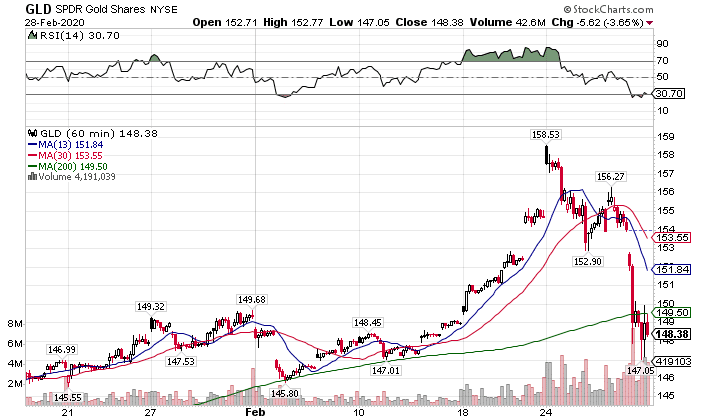

Take a look at gold for starters. The safety trade did well to start the week, only to collapse with equities.

GLD Hourly Chart

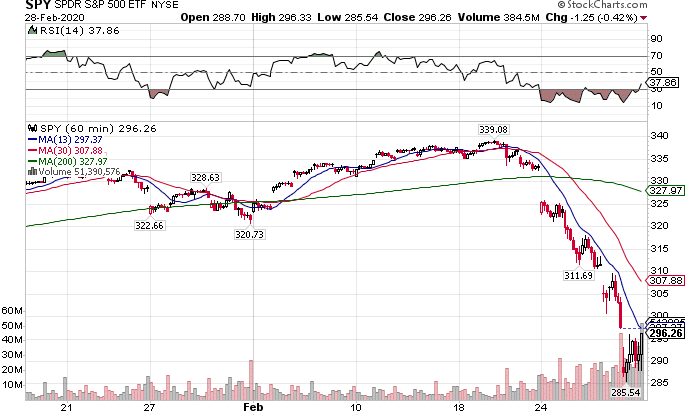

My second clue comes from the volume. Average daily volume in the SPY sat around 63 million shares for most of the last year. This week had no days with less than 160 million shares traded, culminating with a whopping 385.2 million exchanged on Friday.

SPY Hourly Chart

Friday’s volume was the most the SPY has seen in a single day since August 24th, 2015, when volume spiked over 500 million shares.

Every other time we’ve seen close to 350 million shares traded in the SPY it typically marked a bottom for a while. Chances are that we saw capitulation to end last week. But that doesn’t mean the market decline is over.

Will likely see a steady drip of news related to the pandemic for weeks if not months. Most of it will only provide incremental information to digest. Any announcements from companies that lower guidance should be treated seriously. Those have a tendency to move markets.

The only real solution to this market downturn would be a potential treatment for the virus. No amount of intervention from the federal reserve will stem the bleeding in equities. As cases mound in the United States and the developed world, watch for news about the closing of schools and businesses. The longer the disruptions occur, the more of a hit the market will take.

While the democratic primaries would normally hold the focus, I don’t think they hold a candle to the pandemic. It’s certainly worth paying attention to how things progress for moderate and liberal candidates. But until the coronavirus recedes from view, this will only be background noise.

Expected earnings dates listed in (…)

Stocks I want to bet against…

TLT (none), ZM (Mar 4) , TDOC (May 5)

Stocks I want to buy…

DIS (May 13), MJ (none), UNG (none), XLE (none), WDAY (Feb 27), PTON (May 6), TWLO (May 3), UVXY (none), BYND (Feb 17), PBR (Feb 26), OLED (Feb 20), V (Apr 22), PINS (May 21), IRBT (Apr 28), SHAK (Feb 24), DPZ (May 20), GOOGL (May 4), CVNA (Feb 26), COST (Mar 5), CMG (Apr 22), NFLX (April 21), AMZN (Apr 23), AMD (May 5), UBER (Jun 4), GDX (none)

— RECOMMENDED —

Millionaire Trader Reveals Top Trade Idea Each Week

“My strategy aims to help you pull one winner out of the market each week, regardless of market conditions!” – Jeff Bishop

This Week’s Calendar

Monday, March 2nd

- 9:445 AM EST – Markit US Manufacturing PMI

- 10:00 AM EST – Construction Spending and ISM Manufacturing for February

- Major Earnings: Everi Hldgs Inc (EVRI), GreenSky Inc (GSKY), Intrepid Potash Inc (IPI), Livongo Health Inc (LVGO), Allscripts Healthcare Solution (MDRX), PTC Therapeutics Inc (PTCT), Boingo Wireless Inc (WIFI), Diversified Healthcare (DHC), Evergy Inc (EVRG), Amicus Therapeutics Inc (FOLD), GTT Communications Inc (GTT), Intra-Cellular Therapies Inc (ITCI), Dentsply Sirona Inc (XRAY)

Tuesday, March 3rd

- 7:45 AM EST – ICSC Weekly Retail Sales

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Ambarella Inc (AMBA), Cornerstone Building Brands In (CNR), Cytokinetics Inc (CYTK), Health Insurance Innovations (HIIQ), Nordstrom Inc (JWN), Ross Stores (ROST), Urban Outfitters (URBN), Veeva Systems Inc (VEEV), Yext Inc (YEXT), CHF Solutions Inc (CHFS), Intl Game Tech PLC (IGT), Kohl’s Corp (KSS), Target Corp (TGT)

Wednesday, March 4th

- 7:00 AM EST – MBA Mortgage Applications Data

- 8:15 AM EST – ADP Employment Change February

- 9:45 AM EST – Markit US Services & Composite February Final

- 10:00 AM EST – ISM Non-Manufacturing Index February

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: Abercrombie & Fitch Co’A’ (ANF), Campbell Soup (CPB), Dollar Tree Inc (DLTR), Owens & Minor Inc (OMI), Photronics, Inc (PLAB), American Eagle Outfitters Inc (AEO), Guidewire Software Inc (GWRE), Marvell Tech Grp (MRVL), Ping Identity Holding Corp (PING), Pinduoduo Inc (PDD), Splunk Inc (SPLK), Zoom Video Communications (ZM)

Thursday, March 5th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – Non-Farm Productivity & Unit Labor Costs Q4 Final

- 10:00 AM EST – Factory & Durable Goods Orders January Final

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: ADT Inc (ADT), American Outdoor Brands Corp (AOBC), Costco Wholesale Corp (COST), Funko Inc (FNKO), Block (H&R) (HRB), Montage Resources Corp (MR), Okta Inc Cl A (OKTA), Renewable Energy Grp Inc (REGI), Biocryst Pharm’l (BCRX), BJ’s Wholesale Club Holdings (BJ), Burlington Stores Inc (BURL), Ciena Corp (CIEN), Kroger Co (KR), Tech Data Corp (TECD)

Friday, March 6th

- 8:30 AM EST – Non-Farm, Private, and Manufacturing Payrolls for February

- 8:30 AM EST – Unemployment Rate & Average Hourly Earnings For February

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: Baxter Intl Inc (BAX)

Source: TotalAlphaTrading.com | Original Link