For those of you who don’t know, I’m a former elementary school teacher.

I got into stock and options trading out of necessity.

My wife and I were drowning in student loan debt to the tune of $200,000.

During that desperate time, you could find me collecting soda cans after the high school football games to earn a whopping nickel per can.

True story!

And while I am so thankful to be a self-made millionaire — and that Pamela didn’t leave me back then, ha — my passion is and always will be one thing…

Education.

Now, I know that trading options can be intimidating. Trust me, I get it.

That’s why I encourage my premium Weekly Windfalls subscribers to watch me in action via my live trading feed until they’re comfortable placing their own trades.

It’s also why I created this questionnaire for trading credit spreads — for both investors already comfortable with options AND for would-be investors still thinking about implementing my “casino strategy.”

When people want to trade my credit spread strategy, seven common questions should always pop up.

Today I’m going to cover them for you.

Table of Contents

1. Do I Have the Street Cred?

Before we do a deep dive into the necessary questions to ask before putting on a spread, you should first make sure that you’re eligible and have plenty of practice making paper trades.

When buying shares of a stock outright, you usually need only enough cash to cover the purchase, plus any brokerage fees.

It’s typically the same when simply buying a call or put option — you usually need just the cost of the contracts.

That’s because the most you can lose on an outright stock or options purchase is the initial cash outlay.

However, trading credit spreads is a little different.

These typically require a minimum margin requirement of just $2,000, though that could vary among different trading platforms.

However, you could cover that with just ONE fat Windfall , like this one!

It should also be noted that there is a tiered system of approval levels for options traders.

That’s to protect you from getting yourself in too deep.

Specifically, there are four option approval levels, and you’ll simply be vetted by your broker before moving up the chain.

Buying call or put options requires a “Level 2” clearance, while trading spreads requires a “Level 3” badge, which is relatively easy to acquire.

2. What is My SETUP?

This is likely the most important question before implementing ANY trade.

Before you can even start thinking of speculating on a stock, you need to be able to visualize its trajectory.

This, in a nutshell, means some hardcore technical analysis.

You can’t just say, for instance, that you expect shares of Stock XYZ to move from $20 to $30.

Hunches in stock and options trading rarely work out.

The easiest way to scrutinize a stock’s charts is to identify possible areas of support or resistance.

Support can come in many forms: round numbers like $60 or $100, closely watched moving averages like the 50-day or 200-day, or — one of my favorites — a Fibonacci retracement level.

Fibonacci retracement levels often allow stocks that have shot higher to “rest and retest” before bouncing again, allowing bullish traders to BTFD (Buy The Freakin’ Dip, we’ll say).

On the other hand, stocks can also find resistance at round numbers and key trendlines, as well as former highs or notable percentage gains — like the 25%+ year-to-date level, for example.

That’s because shareholders who got in when the stock was cheaper will take profits at these levels.

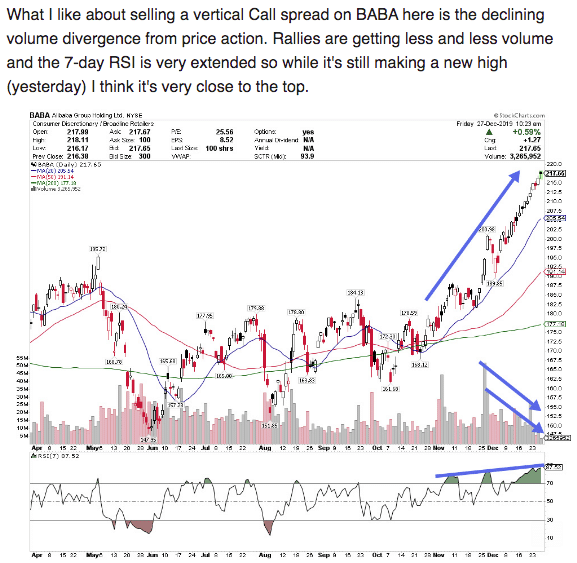

In addition, you should know if the stock is running too hot or too cold.

Shares that have rallied too far, too fast will often be overbought, and vulnerable to a dip.

There are several ways to tell if a stock is overbought, but probably the most common is a Relative Strength Index (RSI) above 70.

Take Alibaba (BABA) here… I recommended a bear call spread on the shares, partly due to a red-hot RSI.

And wouldn’t you know it, my paid Weekly Windfalls subscribers made $5,000 on this trade IN THREE SESSIONS.

Weekly Windfalls premium subscribers saw this BABA trade in real time!

Meanwhile, stocks with an RSI below 30 are considered oversold, and ripe for a short-term bounce.

In a nutshell, support and resistance levels will help you determine your option strikes, and be careful placing near-term bearish trades on overbought stocks, and bullish trades on oversold stocks.

3. What is My PLAN?

Another VERY important piece of the trading puzzle: having a plan of action before placing your bet.

By that I mean you should have a profit target and a stop-loss level.

Now, you don’t have to follow my Weekly Windfalls trades to a T, by any means. But for reference, I typically eye a 50% gain for profit targets on credit spreads.

Of course, different trading strategies will be more conducive to higher or lower profit targets.

For instance, my targeted percentage gains in Jason Bond Picks tend to be much smaller, but that’s because I’m buying small-cap momentum stocks set to explode.

You see, trading options offers you the benefit of leverage vs. buying a stock outright, so you’re more likely to see larger returns on your options investments.

As far as stop-loss levels, it’s a similar story — everyone is different.

It really just depends on your personal tolerance for risk. For me, I try to take losers off the table as quickly as possible.

When you trade credit spreads, though, you also need to be aware of the risk of assignment, which can happen when your sold option is deep in the money at expiration. Traders who want to avoid that should consider setting their stop levels accordingly, or closing their spreads before the options expire.

And speaking of options expiring…

4. What is My Timeframe?

So, you’ve pored over the charts and figured out a plan… The next question is: How soon do you expect this stock move to play out?

As you may have already guessed, in Weekly Windfalls I exclusively trade WEEKLY options.

Most big-cap stocks have weekly options available now, but in the grand scheme of things, these contracts are relatively new to the trading world.

Just a few years ago, options expiration dates were limited to the third Friday of every month. These types of contracts are now known as standard monthly options.

Today, however, short-term traders can utilize options that expire at the close every single Friday!

That is definitely a boon for option sellers like me, especially, who have time decay working in our favor.

So, if you expect the stock you’re stalking to go up or down or sideways (traders of my “casino strategy” can make money in all of those directions, btw) within the next few days, weekly options are probably your jam.

If you’re looking a little further out for your expected stock move, you could try those slightly more expensive standard monthly options.

Longer-term options traders could use the even more expensive LEAPS — or Long-term Equity AnticiPation Securities — which are January-dated options that go out years into the future.

But those types of options are best left for buyers, due to their massive time value — something option sellers should avoid.

5. Are There Any Known Events That Could Mess Me Up?

Once you’ve homed in on a timeframe, you should check the corporate calendar.

Most paid trading platforms (like TD Ameritrade’s ThinkorSwim) offer a calendar option to easily check for events like quarterly earnings.

Personally, I like to check a company’s Investor Relations page, which should have some kind of event calendar.

If a firm is reporting earnings within your timeframe, think twice before putting on that trade — if you’re an options seller, at least.

While option premiums are juicy ahead of earnings, these reports can send a stock shooting way higher or lower in a matter of minutes, meaning the shares could move against you in a big way. And option sellers don’t want their contracts moving into the money (ITM).

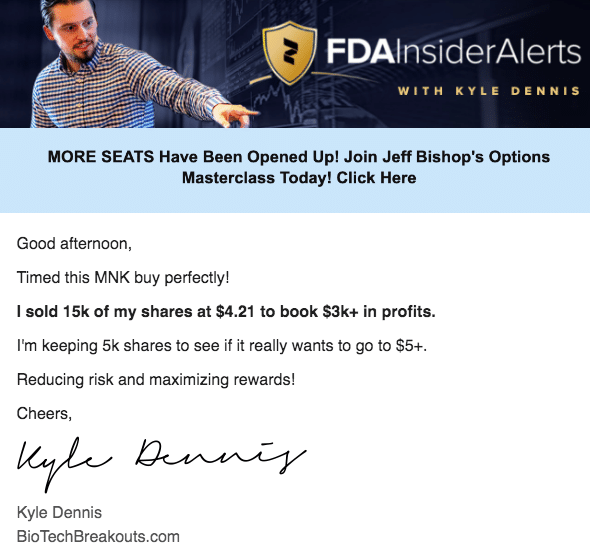

Some sectors could have even more events that might move a stock.

For instance, healthcare stocks could move on things like an FDA approval — which is fine for traders like my protege Kyle Dennis, who is making an absolute killing with FDA Insider Alerts .

Just look at ONE of the winners he cranked out last week in a matter of HOURS.

Sign up for FDA Insider today and get a BONUS SERVICE FREE!

But again, in the case of the credit spreads I crank out in Weekly Windfalls, a known volatility catalyst could ruin your trade.

6. How Much Trading Capital Am I Allocating?

This is another question that is strictly personal.

Many options traders allocate something like 5% of their trading capital to a single trade. For others, it might be higher or lower.

Just remember to stick with your trading plan.

It’s often tempting when you’re on a hot streak to up the ante, so to speak, perhaps dedicating 25% of your trading account instead of 5% to one trade.

The next thing you know, you’re sitting alone at a bar at 3 p.m., flicking stale peanuts and staring at a loss five times more than it should be.

And, once your trading bankroll grows, 5% of your capital will be much higher than before, dollar-wise.

Just ask my long-time friend and fellow teacher Jeff Williams, who grew a Small Account Challenge by ROUGHLY 1,000% in both 2018 and 2019, and is about to do it again!

So, in summary, if you’ve capped yourself to 5% of your capital per trade, don’t deviate — even when it’s reaaaaally tempting.

7. Do I Understand My Risk/Reward?

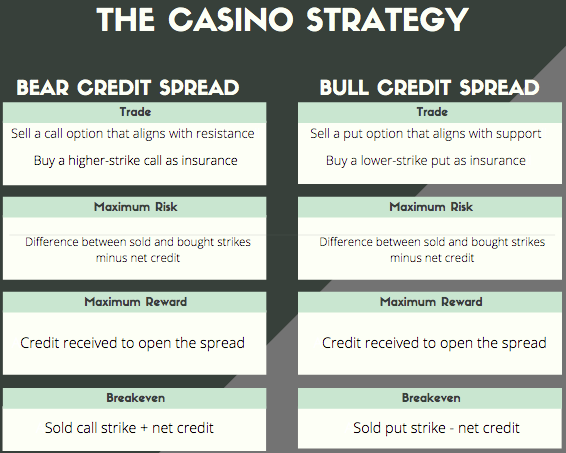

One of the perks about trading credit spreads is the LIMITED RISK.

If the stock moves against you, the most you can lose is the difference between the strikes, less the net credit you received to put on the spread.

That means the closer your sold and bought option strikes, the less you’re risking.

Personally, I tend to go for spreads that are “2.50 wide,” meaning a 2.5-point difference between my sold and bought option strikes.

The net credit (how much you received from the sold option minus how much you paid for the bought option) represents the most you can possibly make on the trade.

I like to risk $12,000 to make $13,000.

Watch over my shoulder as I trade credit spreads in real-time!

Breakeven for bearish credit spreads is the sold call strike plus the net credit, and breakeven for bullish credit spreads is the sold put strike plus the net credit.

Keep in mind, also, that a lot of your risk/reward profile will be determined by the distance between your option strikes and the actual stock price.

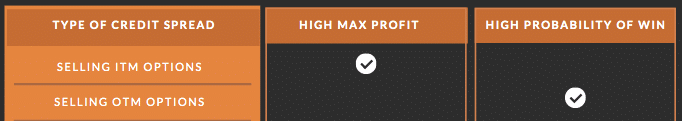

I prefer selling at-the-money (ATM) options, which are options that are roughly in line with the stock’s price. For instance, if Stock XYZ was trading at $20, the 20-strike calls and puts would be considered ATM.

Now, this can get risky — the closer an option is to “the money,” the higher the chances of the stock moving against you. Which means a higher probability of a loss for my spread.

However, I feel like my years of experience as a momentum trader offset that negative probability — I’ve been analyzing charts successfully for years over at Jason Bond Picks.

And while I could go with a safer bet, selling out-of-the-money (OTM) options — which is when the stock is below the call strike or above the put strike — I’d have to sacrifice potential profits on the trade.

In closing, guys and gals, I hope this questionnaire helps you snap some necks and cash some checks!

[Ed. Note: Jason Bond runs

JasonBondPicks.com and TheWeeklyWindfalls.com. In 2015 he earned a 180% return on his money. Then in 2016 he turned a $100,000 account into $430,000! Discover How He Did It]

Source: ragingbull.com | Original Link