Is the market starting to crack or is this just one of those legendary buy the dip opportunities?

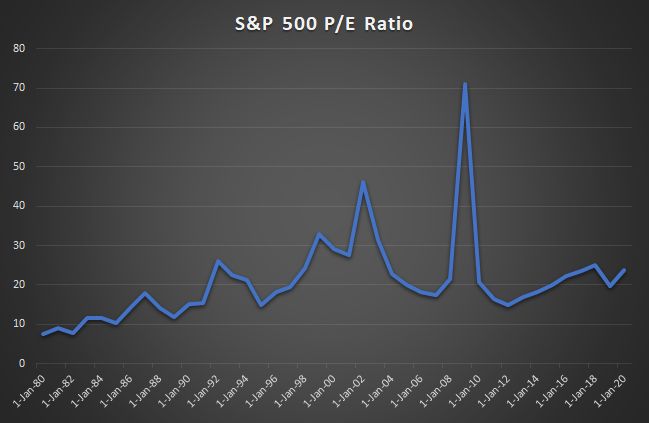

Here’s my take—despite a frothy market propped up by easy money, equities aren’t as overvalued as you might think. With the current price to earnings ratio at 23.77x, it fits within a historical trend that started back in the 1980’s.

Long before the Great Recession, valuations climbed steadily through the 80’s and 90’s. We only got in trouble when clear bubbles formed, and even then it could take years to play out.

Our recent growth has been shallow but predictable. Sure it’s exacerbated by low interest rates. However, most estimates show they boosted stocks by 20%.

The real danger lies in government debt. That’s where we start the jump this week; not on the obvious equity decline, but the lack of a bond breakout.

— RECOMMENDED —

Millionaire Trader Reveals Top Trade Idea Each Week

“My strategy aims to help you pull one winner out of the market each week, regardless of market conditions!” – Jeff Bishop

Table of Contents

Bonds steal your money

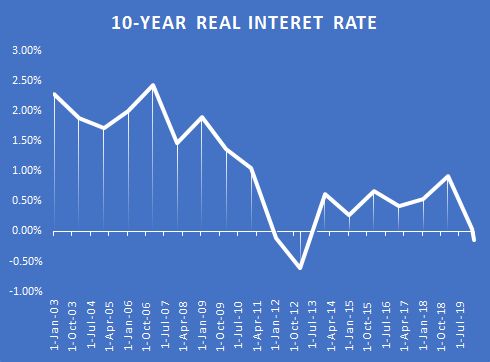

Most of us know that with higher bond prices and lower yields, savers hurt the most. But here’s something you probably weren’t aware of. Right now, the 10-year real interest rate is -0.15%.

Yes my friends, investing in U.S. government debt actually costs you money if you hold it until maturity.

So why would people keep at it? Central bank policy. Governments around the world continue their race to the bottom in hopes of devaluing their currencies. While many claim victory, the recent distribution of wealth has favored a smaller percentage of the wealthy than the broad economic indicators would suggest.

Last year, the Federal Reserve published data that noted how the top 1% share of wealth continues to increase at the expense of the next 9%, as well as the acceleration lower of the next 90%. That becomes somewhat evident when you look at the political environment juxtaposed against the increasing wealth of Jeff Bezos or Mark Zuckerberg.

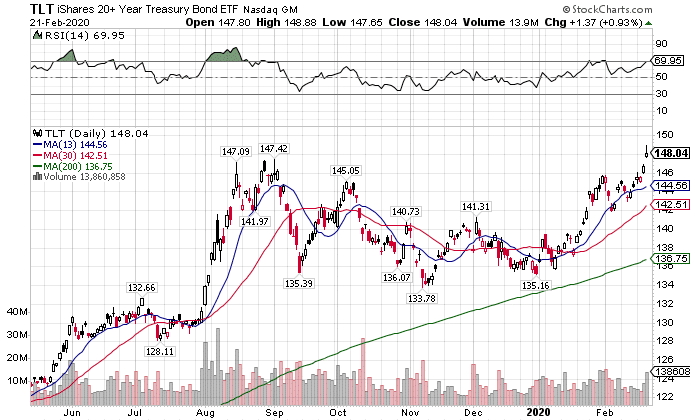

And yet, the Federal Reserve wants to continue to push rates even lower. But their influence may be waning. Compare the breakouts of the TLT to GLD.

TLT Daily Chart

Bonds barely broke out above their previous highs and certainly had trouble sustaining that momentum throughout the day. Compare that to the GLD performance.

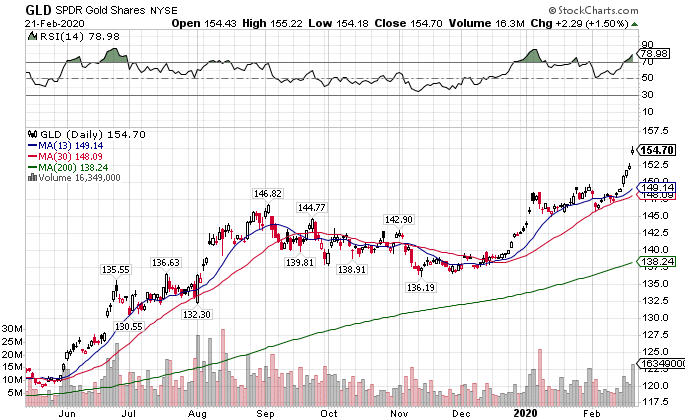

GLD Daily Chart

Not only did gold break out, it did so with a vengeance.

This can best be summed up through the outlook for politics in the coming weeks.

— RECOMMENDED —

THE WINNING STRATEGY THAT WALL STREET HAS BEEN HIDING FROM EVERYONE…

Election mayhem

By the time you read this, the Nevada primary will already have finished. While the winner may be obvious, the likelihood of a contested convention frightens markets. Traders and investors want certainty. A protracted fight that fractures one of the major political parties won’t soothe their fears.

Initially, markets discounted Bernie Sanders as a real contender given he didn’t win 2016. However, the closer we get to the convention, the more worried they become. Even if you like Sanders’ policies, the enormous lift they ask will take years to implement, much further than market participants are willing to look. That means the more likely a left-wing candidate comes to the presidency, the more likely markets will spook.

Super Tuesday adds a wrinkle into the mix as Michael Bloomberg jumps into the race, betting on data science to beat out his rivals. While he may do just that, I guarantee there will be sore feelings if he pulls one out through maneuvering through the system.

As candidates drop out of the race, we’ll likely see markets stabilize a bit more. But as we get into the summer months, volatility will start to expand if history has any say in the matter.

Two black swans fly on the horizon. The first is the somewhat known Coronavirus epidemic. History says that it’s likely to flame out. But we have no way to know for certain. Companies from Apple to Tesla are already warning of supply chain issues.

We’ll likely get drips of information week after week. Most of it won’t do much unless it increases the likelihood of spreading globally or further disrupting the Chinese economy.

That’s likely more of the reason behind the QQQ hard declines relative to the SPY or IWM last week. Many of the companies that make up the Nasdaq 100 will feel some impact from Coronavirus related issues.

The second concern takes us back to Thursday. We saw a decent swing in the market. And yet, even the pundits couldn’t come up with an excuse as to why that happened. Most of them blamed the algos.

What worries me is the lack of any storyline behind the move. We all know that markets are organic systems run by vast networks of computer interactions. Not everything will be apparent all the time. But when you have an intraday decline of that magnitude, and no one can even point to a cause with even limited certainty, that should put up a red flag.

I’ll be keeping an eye on the market these next few weeks, looking for any technical issues that could arise. And you can bet I’ll point them out to you.

Expected earnings dates listed in (…)

Stocks I want to bet against…

NFLX (April 21), AMZN (Apr 23), AMD (May 5), UBER (Jun 4), GOOGL (May 4), CVNA (Feb 26), COST (Mar 5), CMG (Apr 22)

Stocks I want to buy…

DIS (May 13), MJ (none), UNG (none), XLE (none), WDAY (Feb 27), LK (??), PTON (May 6), TWLO (May 3), TLT (none), UVXY (none), BYND (Feb 17), PBR (Feb 26), OLED (Feb 20), V (Apr 22), PINS (May 21), IRBT (Apr 28), SHAK (Feb 24), CVM (May 12), DPZ (May 20)

— RECOMMENDED —

Learn How You Could DOUBLE or TRIPLE Your Account in One Week!

Find Out How With The #1 Selling Trading Guide: Now Yours For FREE!

This Week’s Calendar

Monday, February 24th

- 8:30 AM EST – Chicago Fed National Activity Index January

- 10:30 AM EST – Dallas Fed Manufacturing Activity for February

- Major Earnings: Carter’s Inc (CRI), Epizyme Inc (EPZM), Kosmos Energy Ltd (KOS), Merit Medical Systems (MMSI), Sabra Healthcare REIT, Inc. (SBRA), iStar Inc (STAR), Apple Hospitality REIT Inc (APLE), Apergy Corp W/I (APY), Arlo Technologies Inc (ARLO), Centennial Res Dev Inc Cl A (CDEV), Clovis Oncology Inc (CLVS), Guardant Health Inc (GH), Halozyme Therapy Inc (HALO), HP Inc (HPQ), Hertz Global Hldgs (HTZ), Intuit Inc (INTU), Keysight Tech Inc (KEYS), Kratos Defense & Security Sol (KTOS), New York Mortgage Trust Inc (NYMT), Oceaneering Intl Inc (OII), Oneok Inc (OKE), Palo Alto Networks Inc (PANW), Rent-A-Center (RCII), SailPoint Tech Hldg Inc (SAIL), Shake Shack Inc (SHAK), Tenet Healthcare (THC), Tandem Diabetes Care Inc (TNDM), Xenia Hotels & Resorts Inc (XHR)

Tuesday, February 25th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 9:00 AM EST – House Price Purchase Index for 4th Quarter & S&P CoreLogic Case Shiller December

- 10:00 AM EST – Consumer Confidence for February

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: American Tower Corp (AMT), Chimerix Inc (CMRX), Mr. Cooper Group Inc (COOP), Denbury Resources (DNR), Evolus Inc (EOLS), Entercom Communications Corp A (ETM), Home Depot Inc (HD), Intercept Pharmaceuticals Inc (ICPT), Iridium Communications Inc (IRDM), Lumber Liquidators Hldgs Inc (LL), Cheniere Energy (LNG), Mallinckrodt Pub Ltd Co (MNK), MannKind Corporation (MNKD), Realogy Hldg Corp (RLGY), US Silica Hldg Inc (SLCA), Starwood Ppty Trust Inc (STWD), Tupperware Brands Corp (TUP), Welbilt Inc (WBT), Wolverine World Wide (WWW), B&G Foods Inc (BGS), salesforce.com Inc (CRM), Caesars Entertainment Corp (CZR), Easterly Gov Pptys Inc (DEA), Delek US Holdco Inc (DK), Enlink Midstream LLC (ENLC), Evolent Health Inc (EVH), Exelixis Inc (EXEL), Infinera Corp (INFN), Iovance Biotherapeutics Inc (IOVA), MoneyGram Intl (MGI), MacroGenics Inc (MGNX), Matador Resources Co (MTDR), Outfront Media Inc (OUT), Pennsylvania Real Es Inv Trust (PEI), Planet Fitness Inc (PLNT), Insulet Corporation (PODD), Pub Storage (PSA), The RealReal Inc (REAL), Rayonier Advanced Mats Inc (RYAM), SmileDirectClub Inc (SDC), Virgin Galactic (SPCE), Supernus Pharmaceuticals Inc (SUPN), Toll Brothers (TOL), Unisys Corp (UIS), Weingarten Rlty Invst (WRI), WW International Inc (WW)

Wednesday, February 26th

- 7:00 AM EST – MBA Mortgage Applications Data

- 10:00 AM EST – New Home Sales January

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: Ameren Corp (AEE), AMC Networks Inc Cl A (AMCX), Box, Inc (BOX), Cars.com Inc (CARS), Chesapeake Energy Corp (CHK), Physicians Realty Trust (DOC), Element Solutions Inc (ESI), Natl Vision Hldgs Inc (EYE), Horizon Therapeutics PLC (HZNP), Lowe’s Cos, Inc (LOW), Liberty Media Corp A SiriusXM (LSXMA), Momenta Pharmaceuticals (MNTA), Moderna Inc (MRNA), Nisource Inc (NI), Oasis Petro Inc (OAS), Office Depot (ODP), Papa John’s Intl (PZZA), Sabre Corp (SABR), Sinclair Broadcast Grp’A’ (SBGI), SeaWorld Entertainment Inc (SEAS), Smucker (J.M.) (SJM), Stratasys Ltd (SSYS), TJX Companies (TJX), VEREIT Inc (VER), The Wendy’s Co (WEN), Wyndham Destinations Inc (WYND), ACADIA Pharmaceuticals Inc (ACAD), Adaptive Biotech Corp (ADPT), Apache Corp (APA), Biomarin Pharmaceutical (BMRN), Crown Castle Intl Corp (REIT) (CCI), CoreLogic Inc (CLGX), Mack-Cali Realty (CLI), Callon Petro (CPE), Carvana Co Cl A (CVNA), Editas Medicine Inc (EDIT), Equitable Holdings Inc (EQH), Etsy Inc (ETSY), L Brands, Inc. (LB), Marriott Int’l Cl A (MAR), MEDNAX Inc (MD), Nutanix Inc Cl A (NTNX), Natera Inc (NTRA), Portola Pharmaceuticals Inc (PTLA), The Rubicon Project Inc (RUBI), Square Inc (SQ), Sarepta Therapeutics Inc (SRPT), Extended Stay America Inc (STAY), Teladoc Health Inc (TDOC), Tutor Perini Corporation (TPC), Universal Health Svcs (UHS), Upwork Inc (UPWK), Viking Therapeutics Inc (VKTX)

Thursday, February 27th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – GDP, Personal Consumption, Core PCE Q4, and Durable Goods January

- 10:30 AM EST – EIA Natural Gas Inventory Data

- 11:00 AM EST – Kansas City Fed Manufacturing Activity February

- Major earnings: Atara Biotherapeutics Inc (ATRA), Best Buy (BBY), Clear Channel Outdoor Hldgs (CCO), Chico’s Fas (CHS), Centerpoint Energy (CNP), Crocs Inc (CROX), Dell Tech Inc (DELL), Discovery Inc Ser A (DISCA), Equitable Resources (EQT), Equitrans Midstream Corp W/I (ETRN), Flir Systems (FLIR), Gannett Co Inc (GCI), Keurig Dr Pepper Inc (KDP), Laureate Education Inc (LAUR), Nielsen Hldgs Plc (NLSN), NRG Energy Inc (NRG), Intellia Therapeutics Inc (NTLA), OGE Energy Corp (OGE), Quanta Svcs (PWR), ServiceMaster Glbl Hldgs Inc (SERV), Stericycle Inc (SRCL), Sempra Energy (SRE), Whiting Petrol Corp (WLL), Washington Prime Grp Inc (WPG), Applied Optoelectronice Inc (AAOI), Axon Enterprise Inc (AAXN), Acadia Healthcare Co, Inc (ACHC), Autodesk, Inc (ADSK), AMC Entertainment Hldg Inc (AMC), American Homes 4 Rent (AMH), Beyond Meat Inc (BYND), CareDx Inc (CDNA), Continental Resources Inc (CLR), Edison Intl (EIX), Live Nation Entertainment, Inc (LYV), MBIA Inc (MBI), Monster Beverage Corporation (MNST), MasTec Inc (MTZ), Mylan NV (MYL), Nektar Therapeutics (NKTR), NeoPhotonics Corporation (NPTN), Occidental Petro Corp (OXY), Pure Storage Inc Cl A (PSTG), RealPage Inc (RP), Range Resources (RRC), Sunrun Inc (RUN), comScore Inc (SCOR), Switch Inc (SWCH), The Trade Desk Inc Cl A (TTD), VMWARE Inc (VMW), Workday Inc (WDAY), Western Midstream Partners LP (WES), WPX Energy Inc (WPX)

Friday, February 28th

- 8:30 AM EST – Personal Income & Spending, PCE for January

- 9:45 AM EST – Chicago PMI for February

- 10:00 AM EST – University of Michigan Confidence Survey February

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: AES Corp (AES), Colony NorthStar Inc (CLNY), EOG Resources (EOG), Foot Locker (FL), Vistra Energy Corp (VST), Wayfair Inc (W)

Source: TotalAlphaTrading.com | Original Link